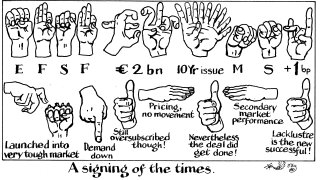

ESM-EFSF

-

Neither issuer has left much on the table for investors

-

Reluctance to show hands has led to smaller books and higher concessions

-

Issuers tasked with resuming public sector's autumn supply in the past will do the same this year

-

‘Quality’ investors flock to new paper as market braces for more supra supply this week

-

Programmable smart contracts set to bring transparency to the market as banks and issuers continue trials

-

Luxembourg-based supranational completed over a third of its annual funding in a single deal

-

Short dated SSA deals offer 'tempting' spread to Bunds

-

Strong demand for euros in primary SSA market extends

-

The issuer paid 2bp of premium on an ‘impressive’ trade

-

Deal gives hope to other SSAs eyeing the market this week as jitters return

-

Issuers put weight on secondary performance as a marker of what makes a good deal as volatility rips through markets

-

Issuer draws smallest demand in years despite Moody’s upgrade this week