Top Section/Ad

Top Section/Ad

Most recent

Mid-cap equity-linked issuance to grow

Schneider refinances Indian acquisition as Wendel uses derivatives to delever

Airline follows Qiagen issue last week

Conditions attractive for convertible issuers to refinance

More articles/Ad

More articles/Ad

More articles

-

'Aggressive' pricing fails to attract investors

-

Relief for bondholders as food delivery app ushers in new credit line

-

Europe's convertible market has been moribund since the end of last year but a revival may soon be on the cards, thanks to rallying equities and rising rates in the region

-

A long drought of new convertible issuance is over in Europe

-

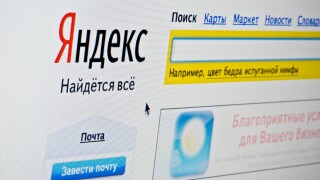

VK, Yandex and Ozon face bankruptcy if bondholders exercise put options triggered by suspension of shares

-

The convertible bond market is experiencing a severe issuance drought, despite looming rate rises