Top section

Top section

◆ How banks and bankers are operating in the region under threat of military escaltion ◆ Bond issuance to resume — but how? ◆ Dwindling fee pool poses questions over long-term future for banks

Toto, I have a feeling we're not in EM anymore

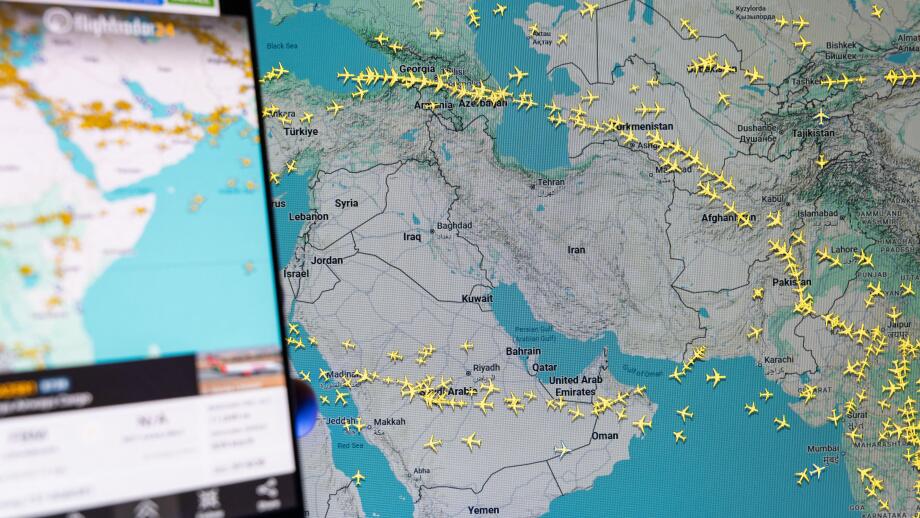

A dozen Middle East bonds postponed as Iran conflict flares

Data

More articles

More articles

More articles

-

Tuesday's 7.5 year sukuk will be the sovereign's second auction

-

December is a strange time to be in the capital markets. Embrace it

-

Volumes led by Gulf issuers, but two more printed this week from elsewhere

-

Company’s trading has been dislocated from Angola’s sovereign bonds

-

Deal comes amid Trump ire, with G20 meetings a flashpoint

-

Tier two printed flat to fair value, says lead

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa