Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

Sovereign gets bigger size and longer tenor in dirham despite closing market

-

PIF's commercial paper programmes have been rated by S&P

-

Tuesday's 7.5 year sukuk will be the sovereign's second auction

-

December is a strange time to be in the capital markets. Embrace it

-

Volumes led by Gulf issuers, but two more printed this week from elsewhere

-

Company’s trading has been dislocated from Angola’s sovereign bonds

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

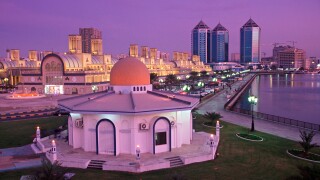

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa