Top Section/Ad

Top Section/Ad

Most recent

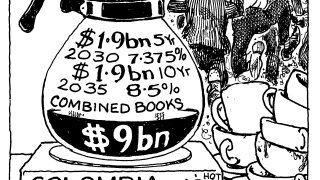

Mexico paid a similar new issue premium for its $9bn deal last week

◆ What has driven this week's record issuance and what might threaten sentiment ◆ Why the Maduro affair is a wake-up call for the EU ◆ Resolving Venezuela's debtberg

New issue premiums were slim for the LatAm sovereign duo

It will take years and huge amounts of money to get Venezuela in a state to restructure its debt

More articles/Ad

More articles/Ad

More articles

-

Peruvian lender brings first non-sovereign deal from the region since April 1

-

The standout deals, issuers, banks and other market participants were crowned at a gala industry dinner in New York

-

Sovereign pays at least 25bp of concession but points to healthy demand after broader spread widening

-

Sovereign bonds have suffered a brutal eight days, like other emerging markets

-

All-in yields no higher for most in secondary as several issuers line up to follow Brazilian duo

-

AfDB's hybrid is main comparable for pricing CAF's benchmark dollar debut but roadshow feedback also holds key