EM Polls and Awards

-

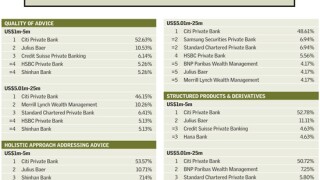

Asiamoney.com reveals the outstanding wealth management companies in South Korea, as voted for by high net worth individuals in our annual Private Banking Poll.

-

ASIAMONEY is pleased to announce the results of our best domestic bank awards for Thailand. Kasikornbank impresses for its concentration on small and medium enterprises amid volatile markets, Tisco Securities impresses with its quality of research, and Siam Commercial Bank stands out for strong debt coverage.

-

ASIAMONEY is pleased to announced the results of its best domestic bank award for Vietnam. Asia Commercial Bank continues to hold out the competition, although a rapidly expanding loan book and falling capital adequacy ratio are of some concern.

-

ASIAMONEY is pleased to announce the winners of our best domestic bank awards for South Korea. Shinhan Financial Group continues to gain the plaudits of market observers for its consistency, Samsung Securities' international aspirations also wins it admirers, and Woori Investment & Securities' bond issuance strength ensure it gets out best debt award.

-

ASIAMONEY is pleased to announced the best domestic bank award winners for Japan. Sumitomo Mitsui Banking Corp. just about stands out in a very weak field of local institutions. Nomura has no such difficulties in equity, easily rising above its rivals, while Mizuho Financial Group beats out stiff competition from the investment bank in debt.

-

ASIAMONEY is please to announce the winners of the best domestic bank awards for Pakistan. Allied Bank overcomes more traditional winners with its foresight to take the best local bank trophy. KASB retains its grip on the best equity house award, and InvestCap impresses for its experience in bonds sales and trading.

-

ASIAMONEY is pleased to announce the winners of our best domestic bank awards for China. China Merchants Bank takes the best bank prize due to its unique strategy and risk management, while CICC's equity strength win it our award in that sector and Citic Securities takes the best debt house gong for its diversity of clientele.

-

ASIAMONEY is pleased to announce the winners of the best domestic bank awards for Singapore. OCBC seizes the limelight for its growth into new lending areas and acquisition of ING's private bank assets, while DBS wins our other two awards for impressive equity and debt franchises.

-

ASIAMONEY is please to announce the winners of our best domestic bank awards for the Philippines. Metrobank's willingness to strengthen its balance sheet ensures that it narrowly beats BDO for best bank, but BDO Capital & Investment Corp. takes the gongs for best equity and debt house, respectively.

-

ASIAMONEY is please to announce the best domestic bank award winners for Indonesia. Bank Mandiri's fine performance is a fitting legacy for departed head Agus Martowardojo, while Danareksa Sekuritas maintains a strong equities trading presence and Bahana Securities impresses with its debt capabilities.

-

ASIAMONEY is pleased to announce our best domestic bank awards for Hong Kong. Bank of China (Hong Kong) takes the prize as the top bank in the city following strong post-crisis performance. Taifook Securities takes back its crown as the top equity house, while HSBC continued domination of Hong Kong’s bond landscape entitles it to our best debt house award.

-

ASIAMONEY is pleased to announce the winners of our annual best domestic bank awards. In India, HDFC Bank narrowly fended off Axis Bank to become the best local bank, but the latter’s powerful debt origination business won it the best debt house award. Plus Kotak Investment Banking seized a best equity house gong with a strong display.