EM Polls and Awards

-

-

-

The best overall firms for FX services as voted by financial institutions and corporates, and the top ranked research analysts and sales individuals in Asia.

-

The full results for the Asiamoney Foreign Exchange Poll 2012, as voted by corporates.

-

The full result of the Asiamoney Foreign Exchange Poll 2012, as voted by financial institutions.

-

The US bank beat out stiff competition to be voted the best overall provider of credit and rates services in ASIAMONEY's second Fixed Income Poll. BNP Paribas was voted the leading commodities house.

-

Innovation in product development, open access and full margin transparency for buysiders and sellsiders were some of the attributes that set CME Clearing apart from its competitors over the last year, according to market participants. That helped the firm land the 2012 Clearinghouse Of The Year award from the editors of Derivatives Week/Derivatives Intelligence.

-

The US bank has been voted the best regional foreign exchange service provider by both corporates and financial institutions, for the second year running

-

With reforms stemming from the Dodd-Frank Act in the U.S. and regulation in Europe and Asia Pacific growing nearer, Cadwalader, Wickersham & Taft’s deep regulatory knowledge base and expertise in commodity, equity structured products, credit derivatives and fixed income set itself apart from its competitors over the last year.

-

As interdealer brokers continued to push to extend their hybrid capabilities between voice and electronic platforms over the last year, sellsiders singled out ICAP’s efficiency in electronic trading and its role as a liquidity provider globally across all asset classes during heightened periods of volatility.

-

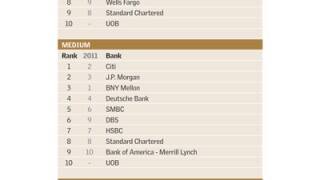

Amid global market uncertainty, the withdrawal of European players from Asia and flurry of bank downgrades, several financial institutions impress regional companies and banks more than ever. ASIAMONEY’s largest Cash Management Poll yet reveals which they are. Chien Mi Wong reports.