Deutsche Bank

-

Two firms are vying to lead European investment banking pack

-

◆ NIB, IADB, CEB price bonds ◆ Busy week drains liquidity from market ◆ Treasury spreads at 'historic' tights

-

◆ Deals offer pick-up to KfW ◆ Saxony offers 1bp of new issue premium ◆ BayernLabo prices tight

-

◆ Larger new issue premiums required ◆ 6bp tighter than Bpifrance ◆ Size set at €2bn

-

Development bank wants to encourage adoption by showing how new standard can integrate with existing green bond issuance

-

◆ Paper is a 'must buy' for some accounts ◆ Pricing breaks trend and tightens 3bp ◆ Orders total over €40bn

-

Americas CEO Stefan Simon to leave for personal reasons

-

◆ No new issue premium paid ◆ Green bond helps build book ◆ Good demand for French agencies

-

◆ Four issuers out in dollars, three in the same maturity ◆ Swap spread moves foil tightening potential ◆ Deals getting done, but market isn't 'white hot'

-

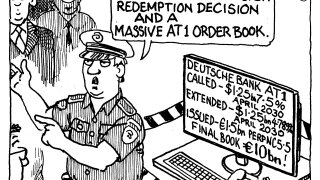

◆ New euro deal more than 6.5 times subscribed ◆ Comes one trading day after a call and non-call decision on two dollar AT1s ◆ Visible new issue premium helps attract orders

-

◆ Deutsche Bank calls one AT1, extends another ◆ Market appears accepting to 'idiosyncratic' event ◆ Metro Bank issues public AT1 with the highest coupon

-

Upheaval in US-Europe relationship could reshape the M&A landscape