Derivs - FX

-

Hong Kong Exchanges and Clearing (HKEX) plans to introduce options on the Chinese renminbi currency, as well as a US dollar/offshore renminbi contract, having gained approval from the Securities and Futures Commission of Hong Kong.

-

In 2016, blockchain went from a buzzword to a ‘must have’ in financial markets, as seemingly every bank and exchange invested in projects and proofs-of-concept. But with so many asset classes having been promised big gains, 2017 begins with a dose of realism about the limits of the technology — and the challenges it poses for regulators. Dan Alderson reports.

-

The Brexit vote and the election of Donald Trump laid bare the poor predictive power of the massed ranks of financial analysts and traders. But when these political cataclysms hit the screens, nothing broke. Everyone from the IMF down to the lowest financial scribbler has warned that markets are less resilient thanks to regulation — but in the turmoil following these votes, prices moved but institutions stayed solid. Owen Sanderson reports.

-

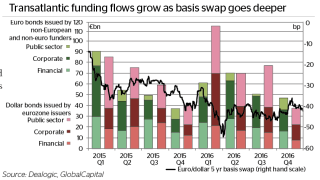

Cross-currency swap markets face a rough start to 2017. Traders fear that diverging central bank policy, a shift in corporate borrowing dynamics and a repatriation of US money will all upset the basis at different parts of the curve. Dan Alderson reports.

-

China and Russia are forging ahead with closer financial market ties, with the Moscow Exchange (Moex) and Shanghai Stock Exchange (SSE) looking to facilitate two-way investments between the countries. This comes as the Russian ministry of finance is still finalising plans for the first RMB-denominated bond to be issued in Russia.

-

The International Organization of Securities Commisions, IOSCO, has identified various risks in how complex over-the-counter leveraged products are sold to retail investors.

-

The Bank for International Settlements’ triannual survey found that the renminbi has risen above other emerging market currencies in trading patterns across spot and derivatives, BIS said in a detailed report on the state of global foreign exchange (FX) markets.

-

The Chicago Mercantile Exchange has appointed a president for clearing and post trade services, a newly created title at the firm.

-

Clearing houses, lawyers and derivatives specialists have spent this week poring over Europe’s proposed rules for central counterparty recovery and resolution, with question marks still hanging over how each case will be assessed and how banks should capitalise their exposures.

-

Intercontinental Exchange has appointed a chairman for its Singapore trading and clearing operations.

-

The UK’s Royal Mint has partnered with the Chicago Mercantile Exchange Group to create a blockchain-based digital platform for trading gold, in an attempt to cut costs for investors and improve perceptions of the asset class.

-

The International Swaps and Derivatives Association and IHS Markit have unveiled the ISDA 2016 Variation Margin Protocol, which automates amending collateral documents or setting up agreements to comply with variation margin requirements from March 1.