Derivs - Credit

-

The cost split of using the Derivatives Service Bureau has finally been released but some trading venues are still absent from its fee structure.

-

Nomura has promoted several of its senior fixed income traders, giving out global responsibilities to seven individuals.

-

In our last article of 2017 we noted that it was widely billed as the year of political risk. Perhaps those in the fixed income world will call 2018 the year of TLAC (total loss absorbing capacity).

-

The European Securities and Markets Authority (ESMA) has gone public with its concerns over the fees that trade repositories charge their clients and made recommendations for change.

-

Two US senators have scolded the European Commission's efforts to unilaterally change agreed rules for the oversight of foreign clearing houses in the wake of Brexit, backing the toughening position of Commodity Futures Trading Commission chairman Christopher Giancarlo.

-

Chief executive of the International Swaps and Derivatives Association (ISDA) Scott O’Malia on Monday said that the trade body was preparing French and Irish law governed ISDA master agreements to be “ready for all eventualities” in the wake of Brexit.

-

The European Securities and Markets Authority (ESMA) on Monday issued a consultation on draft guidelines that would oblige central counterparties (CCPs) to disclose “parameters and information” on the way they calculate margin requirements for trades.

-

After much heated debate, the Derivatives Service Bureau (DSB), which generates international securities identification numbers for some over the counter derivatives, seems to have successfully navigated the first week of the Markets in Financial Instruments Directive’s second coming.

-

IHS Markit on Wednesday announced that Lord Browne of Madingley and Nicoletta Giadrossi have joined as board directors of the company, while its president and COO Lance Uggla became CEO on January 1.

-

Deal-contingent products — flexible derivatives for hedging the FX risk of cross-border acquisitions — are moving from the private equity industry to other markets. Infrastructure is considered a prime fit for the tool. But tricky accounting standards and incoming regulation could complicate the instruments’ roll-out to new users, writes Ross Lancaster.

-

With yields compressed and equity volatility at a historically low level, hunting for consistent returns has been a challenge for asset managers and institutional investors alike. But as Costas Mourselas reports, the meteoric rise of risk premia strategy, a type of passive investing, promises to at least partially alleviate those woes.

-

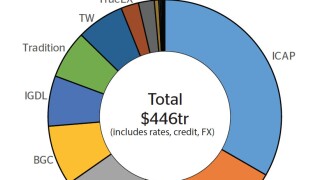

Five years after being pushed on to trading venues in the US by the Dodd-Frank Act, over-the-counter derivatives players are beating a similar path in Europe, under the Markets in Financial Instruments Directive II. Most people think MiFID II has been a worse experience, and will make it harder for small players. But efficiency gains may follow. Ross Lancaster reports.