CTBC

-

Vietnamese firm wraps up second fundraising of the year as sentiment towards the country's borrowers shows signs of turning

-

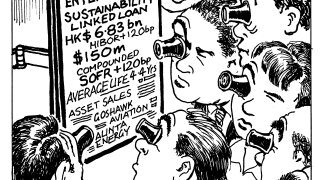

The aircraft leasing company attracted Chinese, Taiwanese and international banks during syndication

-

-

-

-

The $150m loan is expected to be launched to the market in mid-October

-

-

Taiwanese banks turned up in force to support the South Korean deal

-

The banker will be focusing on leveraged finance and loan syndication

-

-

-

Jewellery-to-property firm makes loan return, soon after divesting some of its assets