Barclays

-

Market tipped to be a marathon, not a sprint, as Aareal Bank becomes fourth issuer of 2026 and fixed rate tranches take root

-

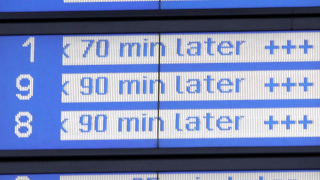

◆ French issuers weighing deals for next week ◆ 'Smaller projects' may come this week ◆ Blackouts blamed for Wednesday's drop in issuance

-

◆ Aussie bank tightened 9bp through execution ◆ Deal more than six times oversubscribed ◆ Bank's last euro covered was in September 2023

-

◆ Australian bank planning €500m covered ◆ Issuer's first euro deal since September 2023 ◆ Barclays, Natixis and UBS are lead managers

-

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

-

Market participants doubt primary market can maintain its rapid pace

-

◆ Bank placed bond at 68bp over mid-swaps after large tightening◆ Banker said bond priced inside Israeli sovereign ◆ Issue offered ‘savings versus seniors’

-

Largest Israeli bank sees itself as a pioneer in its domestic bond market

-

Israel's biggest bank by assets picked Barclays, Goldman Sachs, JP Morgan and UBS as bookrunners

-

Middle of next week eyed for first deals of year

-

Tighter senior-covered bond spreads could see issuers prioritising unsecured over covereds

-

Corporate hybrid issuance up over 70% in 2025 as borrowers refi