Bangkok Bank plc

-

The Kingdom of Thailand pulled off a novel sustainability bond in the domestic debt market on Thursday, hitting the upper end of its Bt30bn ($965m) size target and getting away with tight pricing.

-

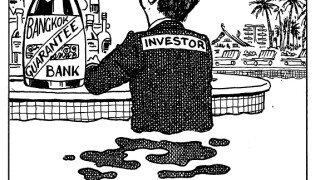

Thai hospitality company Minor International (Mint) used a guarantee from Bangkok Bank to issue a $300m bond this week. The deal structure, which echoes its 2018 debut bond, helped quell investor concerns about how Covid-19 has ravaged the borrower’s business. Morgan Davis reports.

-

Strong demand for Bangkok Bank’s dollar-denominated Basel III-compliant tier two transaction allowed Thailand’s largest lender to sell a bigger deal at a tighter price than expected, writes Addison Gong.

-

Bangkok Capital Asset Management (BCAP) has become the latest firm to sign up to the Depository Trust & Clearing Corporation’s (DTCC) Central Trade Manager (CTM) platform.

-

Yoma Strategic Holdings has become the first company from Myanmar to sell an international bond, raising the equivalent of $70m in the Thai baht market.

-

Thai hotel operator Minor International had to get creative with its debut $300m bond, owing to its lack of rating and inaugural status. It looked abroad for inspiration, ultimately opting for a South Korean-inspired structure. Morgan Davis reports.

-

An extensive global roadshow paid off for Bangkok Bank’s dual-tranche $1.2bn outing on Wednesday, with a strong turnout from accounts in the US as well as Asia.

-

Digital Telecommunication Infrastructure Fund has raised Bt53.2bn ($1.7bn) after pricing a sale of new units at the top of guidance, according to a banker on the deal.

-

Bangkok Bank has sold a chunk of its stock in Jasmine Broadband Internet Infrastructure Fund, raising Bt4.4bn ($140.7m) after boosting the size of the trade.

-

The Lao People’s Democratic Republic, through the Ministry of Finance, raised Bt14bn ($420m) this week from a six-tranche bond in Thailand — its largest ever print. The sovereign also managed to push out its curve to an unprecedented 15 years, leveraging on Thai investors’ familiarity with its credit.

-

Lao People’s Democratic Republic is taking bids for a six-tranche Thai baht bond this week, and is hoping to settle the Bt14bn ($420m) transaction on Thursday.

-

Thai department store operator Central Group is understood to have enlisted two lenders for a loan of about $1bn to back its acquisition of Big C Vietnam.