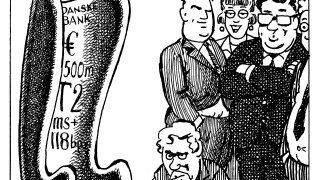

Danske Bank

-

◆ Both legs of dual tranche tightened ◆ Only one covered has landed tighter this year ◆ Banker said both tranches were at fair value

-

◆ Two banks launch deals in same tenor and asset class ◆ Danske secures tighter price◆ Nationwide's book 'underwhelms'

-

◆ Both issuers advance 2026 funding plans ◆ LBP issues its first senior bond of the year ◆ Danske prints 20bp tighter than similar May deal

-

◆ Both issuers advance 2026 funding plans ◆ LBP issues its first senior bond of the year ◆ Danske prints 20bp tighter than similar May deal

-

◆ Combined demand peaks at more than €5.1bn ◆ Yield curve drives investors towards seven year ◆ No premium needed to hit size targets

-

◆ New senior non-preferred bond comes a month after defence-labelled senior preferred ◆ Improved sentiment towards new French government ◆ Danske Bank finds 'strong' appetite for tight FRN

-

US FIG issuance spikes above $90bn ahead of expected Fed rate cut

-

High demand for senior and tier two debt keeps deals rolling in

-

◆ Green label and capped size set up tight pricing ◆ Result is Danske's tightest tier two, beating Covid-era issuance ◆ Some first mover advantage gained

-

◆ Minimal impact from escalating Middle East conflict ◆ Investors eager to buy long end BPCE ◆ Danske lands flat to Pfandbrief

-

◆ Hesse prints largest European regional green bond ◆ ESM builds 'massive' book ◆ CDP tightens pricing by 6bp

-

◆ IDA fair value more art than science ◆ MuniFin gets over 140 accounts in its book ◆ Madrid makes debut EuGB trade