Credit Suisse

-

Edwin Schooling Latter will be head of regulatory relations for UK and EMEA at the Swiss bank

-

Enrique García Pazos is latest to fall victim to the bank's widespread redundancy programme

-

BNP Paribas completed its third dollar AT1 this year at a level well through where a deal would have come in the euro market

-

-

After offering juicy concessions in euros and attracting broad investor base, Swiss lender starts marketing dollar deal

-

The Swiss bank has put two emerging market bankers at risk; cuts also begin in DCM

-

The Swiss bank's MD plans to work as an independent adviser

-

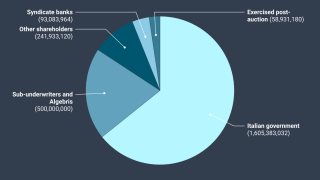

Deal covered 0.52 times as bookbuilding moves to final leg

-

Glocos relieved by 'better than anticipated' result

-

The chairman of SNB rules out increasing its stake in Credit Suisse but says an alliance between the two banks could be possible

-

Swiss lender hit with a flurry of downgrades as agencies respond to restructuring plan but the sale of its Securitized Products Group was seen as a positive for its credit

-

Bankers on the deal are confident about auctioning the remaining rights