Crédit Agricole

-

◆ Orders pour in, crushing new issue premium ◆ Pricing well through French sovereign ◆ Market warming to longer-dated paper

-

Middle of next week eyed for first deals of year

-

Spanish bank's research says heavier-than-normal redemptions in 2026 will pressure euro covered net supply

-

France’s investment banking market recovered strongly in 2025 but that doesn’t mean domestic banks are happy. The market is super-competitive and US firms are winning many of the best mandates

-

Steepening swap curve has revived interest in long-dated covereds

-

None of the four largest covered issuers of 2024 made the top five by deal volume in 2025

-

Natixis has grown its covered bond business in Australia and the Nordics this year, its head of FIG DCM said

-

Covered bond redemptions are set to increase by €20bn next year and €30bn in 2027

-

French bank predicts euro, sterling and dollar issuance will all grow next year

-

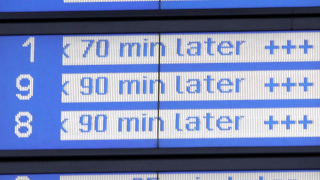

Markets adjust to bumpy French political landscape as it mimics past Italian wobbles

-

◆ Playing for size at 'defensive' tenor ◆ Some concession paid ◆ Better to print now than in 'crowded' January

-

Six covered bonds were issued in three days this week but there is uncertainty over the pipeline from here