Coronavirus

-

The repeated presence of European issuers in the bond market of late is testament to the prudence with which they are building up capital for what could be tough times ahead.

-

Austria mandated banks on Tuesday to lead its second century bond, in what will be a litmus test for investor appetite in the ultra-long end of the curve since the outbreak of the Covid-19 crisis.

-

The Nordic Investment Bank raised NZ$400m ($260.9m) with its return to the Kauri market on Tuesday, as it prepares to wind down its funding ahead of the summer break.

-

Banks are hoping that there will be more European primary capital raising in the weeks ahead as companies begin to assess what will be needed to rebuild their balance sheets and whether the time is ripe for growth. A €341m share trade in German firm CompuGroup Medical on Monday night may show a way forward for issuers.

-

CNP Assurances and Helvetia Europe have added to issuance momentum in the insurance sector, giving investors the chance to put money into subordinated capital. The tier two bonds showed that ‘the market is back in shape’, said one deal arranger.

-

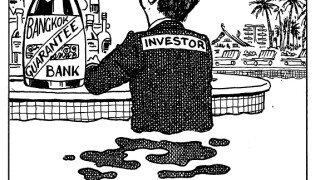

Thai hospitality company Minor International (Mint) used a guarantee from Bangkok Bank to issue a $300m bond this week. The deal structure, which echoes its 2018 debut bond, helped quell investor concerns about how Covid-19 has ravaged the borrower’s business. Morgan Davis reports.

-

Philippine oil refining and marketing company Petron has approached its relationship banks for a new club loan, after acknowledging the impact of the Covid-19 pandemic,

-

VTR Finance, the Chilean subsidiary of telecoms group Liberty Latin America, is marketing a dual-tranche refinancing that is likely to be distributed to both EM and dedicated high yield bond buyers and will shift debt towards the operating company.

-

Trinidad and Tobago tapped bond markets for the first time for four years on Monday with a deal that its finance minister claimed “achieved what our detractors said was impossible”.

-

Bankers said that Uruguay could provide a stern test of risk appetite if it decides to announce a new bond issue in local currency, after the sovereign began investor calls saying it could issue in dollars and/or Uruguayan pesos.

-

Bankers close to SIA, the state-owned Italian payments company, say they expect that it is more likely to pursue a merger with fellow Italian payments company Nexi rather than a listing in Milan this year. However, GlobalCapital understands that SIA is still running a dual-track process, meaning hopes of a public sale are not dead yet.

-

NRW.Bank has mandated banks to arrange a series of virtual fixed income meetings as it looks to present its new social bond framework to investors ahead of a debut deal in the format.