Covered Bonds

-

Wide open window this week as market searches for willing issuers

-

What is a bank really buying when it pays for a former prime minister to be a special adviser? Do they really give advice, and just how special can it be?

-

◆ Stellar conditions for issuers across the bond market ◆ How bond issuance will pan out over the rest of the year ◆ Dedollarisation discussion

-

Opportunistic summer issuance expected and early start at end of August

-

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

-

PPs and club deals allow for greater execution certainty in a stilled market, say bankers

-

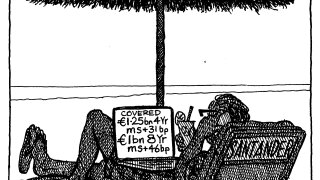

Santander's popular dual tranche deal could spur others to follow, but flood of trades is unlikely

-

◆ Deal attracts more than €10bn ◆ Rarity of name and jurisdiction fuels demand ◆ No premium needed to take size

-

Increased residential lending demand could help support issuance

-

Issuance window is open and conditions are great but issuers stand pat

-

After a poor start to 2025, a strong second quarter helped lagging covered supply get back on track

-

Internal hire ends seven year stint in covered bond research