Comment EM and The Cover

-

The UK securing a trade deal with the EU will be crucial for UK companies wanting to raise equity capital next year. It will give shareholders far more confidence in future revenues that have already been rocked by Covid-19.

-

Little lenders are being pushed closer to collapse in the UK by rules that were supposed to make them more resilient. The Bank of England should take note.

-

With the inauguration of US president-elect Joe Biden in January will come increased expectations of further sanctions against Russian figures and corporates. Russian issuers should take advantage of the rally initiated by Biden's election performance and follow their sovereign into bond markets to raise cash while the going is good.

-

As the UK and the EU prevaricate over the terms of a future trading relationship, equity investors seem to be ignoring the lack of progress in negotiations and the dangerous possibility of a deal between the pair not being struck before the Brexit transition period ends in just a few weeks.

-

-

It felt like a great weight had been lifted from financial markets this week. Two weights in fact.

-

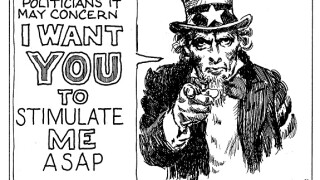

Just because it seems unlikely that in the US election the Democrats will take both the White House and the Senate, it does not mean that capital markets should become despondent about a fiscal stimulus package that could have reached $2.3tr had the so-called "blue wave" made a clean sweep.

-

It’s a pity the irreversible damage to our world’s lungs through the wanton destruction of its rainforests does not come with the same stark health warning found on a packet of cigarettes. If it did, the world’s largest banks and asset managers might be shamed into giving up their dirty habit.

-

Capital markets players have a variety of stances on the forthcoming US presidential election. A survey by UBS this week found 51% of wealthy US investors wanted Joe Biden to win, while 55% of business owners favoured Donald Trump.

-

GlobalCapital has argued that it is not the ECB’s job to exclude individual borrowers’ bonds from its list of repo-eligible securities on environmental grounds, in response to our call for the Province of Alberta’s debt to be removed from its list of eligible marketable assets (EMA). We maintain that the ECB has plenty of justification to exclude this borrower.

-

One by one, banks are taking responsibility to help fight climate change, by setting targets to eliminate carbon emissions from their whole financing portfolios by 2050. This will not suffice. Banks must learn a new way of interacting with clients.

-

Equity markets are pricing in a big win for Democrats in the US elections in November, meaning a large post-election stimulus package to help the economy through Covid-19. However, they should be wary as president Donald Trump is far from beaten.