CITIC Securities

-

Zhihu has kicked off the roadshow for its US listing. The Chinese company is aiming to raise up to $632.5m from the public market, and a further $250m from a handful of high-profile investors through private placements concurrent to the IPO.

-

Zhejiang Geely Holding Group Co used a standby letter of credit from Bank of China's Singapore branch to price its $400m bond inside fair value.

-

The Hong Kong Stock Exchange has had a stellar week, hosting two secondary listings worth about $6bn in total in quick succession. The latest out of the gate is Chinese video sharing and gaming platform Bilibili, which kicked off a potential $3bn float within hours of internet giant Baidu wrapping up its multi-billion-dollar deal. Jonathan Breen reports.

-

Ford Automotive Finance (China) has wrapped up a Rmb3.203bn ($492.3m) auto loan ABS deal, its first outing in the domestic Chinese market this year. Mercedes-Benz Auto Finance is also looking to make its first appearance of 2021 next week.

-

Five banks are set to bring nearly Rmb60bn ($9.23bn) of subordinated bond supply to China’s domestic market this week, making it the busiest week for onshore bank capital deals so far this year.

-

Property manager S-Enjoy Service Group has raised HK$1.04bn ($133.9m) from a sale of primary stock, boosting the size of the deal after strong demand swiftly covered the book.

-

Alibaba Group Holding-backed artificial intelligence company Megvii Technology has officially filed for a Rmb6bn ($922m) listing of Chinese depository receipts on Shanghai’s Nasdaq-style Star board.

-

Chinese internet giant Baidu has met with a rapid flood of early demand for its Hong Kong secondary offering, which is expected to raise around $3bn.

-

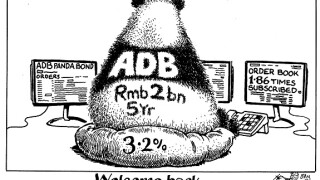

The Asian Development Bank broke a decade-long absence from China’s domestic market to price a Rmb2bn ($307m) Panda bond at a record low spread this week. Its assistant treasurer told GlobalCapital that the multilateral development bank is open to selling longer dated and green renminbi-denominated deals. Addison Gong reports.

-

Secondary listings in Hong Kong got a fresh boost this week with online car marketplace Autohome pricing its deal and internet giant Baidu getting ready to roll out its transaction. More homecomings by US-listed Chinese companies are in the pipeline, but the number of viable candidates is shrinking, writes Jonathan Breen.

-

Coupang, a South Korean e-commerce company, scooped up $4.2bn from its IPO this week, after pricing the deal above the marketed range. It is the largest US listing from Asia since Alibaba Group Holding raised $25bn seven years ago.

-

Chinese internet company Baidu has filed updated offer documents for its Hong Kong secondary listing, the final step before it launches its potential multi-billion-dollar deal.