Citi

-

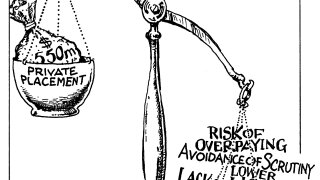

Investors dislike the lower transparency and liquidity inherent in private placements

-

SSA issuers find investors receptive as summer pushes on

-

Issuer starts with rare sterling seven year and mandates for new dollar dual-trancher

-

ADB also issuing in sterling as participants expect more issuance

-

Supra to bring one more dollar benchmark before year-end

-

Far left and right could attack tax breaks and pro-business climate that have fostered growth

-

Viswas Raghavan has taken charge of Citi’s investment banking division following the resignation of its top executive

-

SSA issuers priced before US inflation data is announced

-

Dollar-based funders return to the primary market

-

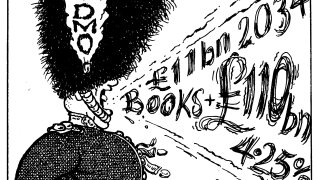

Issuer grabs one of its largest ever books in usual July trade

-

Sovereign's new seven year deal and tenor offer followed recent rating upgrades

-

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors