Citi

-

US money centre bank makes dash for the dollar market as banks and insurers jump to take advantage of strong funding conditions

-

US inflation figure helpful to issuers in both markets

-

Dubai cool water manager completes flotation after two size increases

-

Issuer plans euro and dollar bond issue before spin-off from General Electric

-

The sovereign brushed off recent turbulence to summon over £47bn of orders for its £6bn syndication

-

Rare deal is covered before launch but bankers warn the listing may be a 'one-off'

-

Strong start to what could be a busy two weeks as corporate issuers get last funding of year done

-

Glocos relieved by 'better than anticipated' result

-

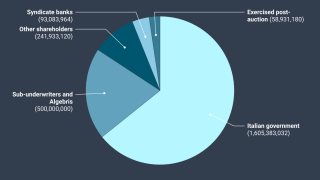

Bankers on the deal are confident about auctioning the remaining rights

-

The petrochemicals company’s shares fell after it announced it will sell a $750m convertible

-

Veteran banker adds whole of Europe to his responsibilities and will relocate to Paris

-

Two more issuers will also launch deals this week