CIBC World Markets

-

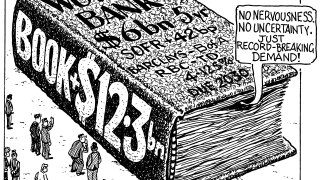

◆ Foreign FIG issuance so far in 2024 outstrips last year’s volume by more than $20bn ◆ Multiple Canadian and Japanese lenders print ◆ US banks prepare capital plans after the Fed’s latest stress tests

-

Redemptions, limited supply and a favourable rates outlook created a window for the issuer

-

Not all issuers drew large oversubscriptions in mixed market

-

At least four issuers will price dollar deals of between three and 10 years on Tuesday

-

German issuer upsized the deal despite sell-off in rates

-

◆ Canadian bank kicks off new quarter for US market after strong Q1 ◆ Local insurers fund in absence of bank deals ◆ Focus turns to US bank results

-

Dollar SSA issuance to build, though euros offering tighter pricing for many

-

Issuer has done nearly €3bn of its €10bn programme and may return in March

-

Luxembourg-based supra leads Tuesday’s deals as EDC and Land NRW also enter market

-

◆ Duration and spread demand dictate investor demand even at tighter valuations ◆ Rabo exemplifies this trend into a €1bn 10.5 year SNP that was more than six times subscribed ◆ NBG and CIBC also print with arguably no concessions left

-

US dollar market helped the province to raise an equivalent of five to six domestic bonds

-

Banks seized the opportunity to fund in challenging markets ahead of a looming US government shutdown and increased rates volatility