Chile

-

Investors saw plenty of juice in first public AT1 from Chile as regulatory framework draws praise

-

Top sovereign opts for defensive maturity and bucks trend of LatAm issuer generosity

-

Chilean bank targets gap in the market with three year deal

-

Public debt office keen to encourage foreign buyers into inflation-adjusted bonds

-

LatAm sovereign includes emissions and gender-related KPIs in first ever syndicated deal in inflation-adjusted unit of account

-

Spree of global local currency issuance is a reminder of a key strength in many countries in the turbulent region

-

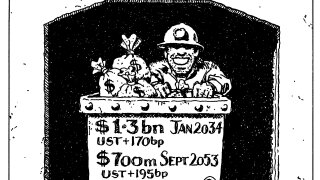

JBS also sells a dual-tranche as well-known names waste no time after Labor Day

-

IDB Invest deal backed by government-guaranteed securities offers 90bp pick-up to sovereign

-

Proposed new issue is a securitization of IDB Invest’s purchase of securities from electricity generation companies

-

Next deal could include targets on climate change adaptation or biodiversity

-

Sovereign jumps on strong demand for local currency to expand its stock of ESG debt

-

Chilean power company was rated investment grade by S&P just three years ago