Central Asia

-

A successful print for Development Bank of Kazakhstan could encourage more CIS issuers

-

The Kazakh development bank's new issue would be the first from the country since unrest in January

-

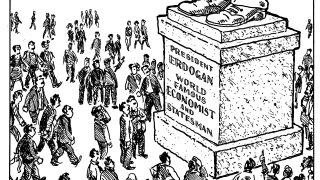

Bondholders consider ramifications of shock uprising for Turkey, Russia and beyond

-

An uprising in Turkey inspired by the protests this week in Kazakhstan would not be a huge surprise

-

Investors are pondering the fate of Russian bonds after it despatched military personnel to quell Kazakh unrest

-

Investors spooked by violent Kazakhstan protests

-

Hard commodity bonds pique investor interest

-

-

Uzbekistan re-entered the international bond markets on Monday for its third ever issue. The dual currency bond it was marketing aimed at drawing in the widest possible investor base, market participants said

-

The Republic of Uzbekistan is seeking to capitalise on a successful dual currency bond it sold just months ago, by returning to the bond market to sell a dollar and Uzbek som bond that also includes a sustainable element.

-

GlobalMarkets: How is Uzavtosanoat benefitting from the economic reforms in the country?

-

GlobalMarkets: SQB has been identified as an upcoming privatisation candidate. That usually requires a lot of work to get an institution ready for that process. What is SQB doing to prepare itself?