Central and Eastern Europe (CEE)

-

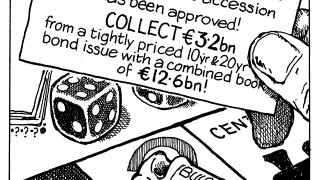

The sovereign also issued one of the longest date deals from a CEEMEA sovereign this year

-

Two rating agencies upgraded Bulgaria last week ahead of likely eurozone accession

-

The real estate company will use some of the funds for a tender offer of its bonds due in 2029

-

New issue premiums were slim on the dollar bonds and euro tap, despite the huge combined size

-

Romania's sovereign bonds have enjoyed a rally after May's election

-

◆ Bank treasurer speaks following after debut tier two in euros ◆ Deal reintroduces Polish tier two debt in the public euro market ◆ mBank next plans new SRT and SNP refi

-

Spread for Romanian utility's deal set flat to fair value with books over 10 times covered

-

-

Romgaz trades flat to Romania's sovereign

-

Sovereign's 12 year note is its first green deal for six years

-

◆ SSA market faces up to escalating defence funding ◆ Arms company bonds in focus ◆ Slovenia's landmark SLB

-

Sustainability-linked bonds are the market’s best megaphone