Cartoon

-

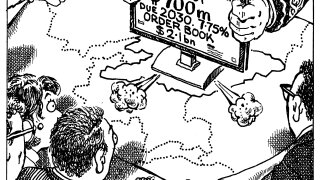

With conditions this good, it makes sense for companies to take a dip

-

Sustainability-linked bonds are the market’s best megaphone

-

◆ Thames Tideway Tunnel brings rare blue bond… ◆ …and a rare IG corporate sterling bond ◆ Deal lands with single digit concession

-

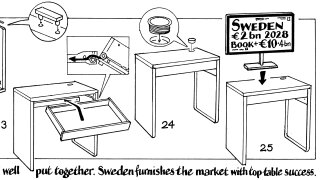

◆ Scarcity value draws buyers ◆ Nordic investors lured by big pickup against krona ◆ Bankers debate euro or dollar for next international bond

-

Enjoy the roaring markets while you can, they won't last long

-

New faces in euros could be thin end of the wedge as Pacific Life introduces first green FABN

-

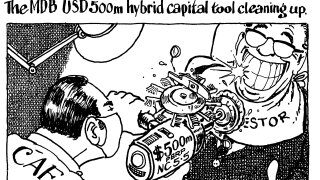

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

A fun and upbeat anti-Trump trading meme belies the trouble bubbling away in the guts of White House policies

-

◆ Sovereign bags another huge book ◆ Rare five year paired with 12 year green tap ◆ €59bn raised from four syndications this year

-

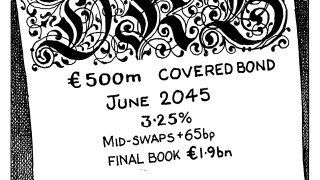

◆ Highly regarded issuer prints longest covered bond for three years ◆ Deal is more expensive than SSA debt... ◆... but investors show strong demand at 'fair' price

-

European banks progress with capital raising as spreads tighten, but investor qualms grow

-

Pricing was tight after sovereign found healthy demand