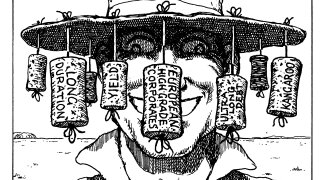

Cartoon

-

Issuers could find the next 12 weeks a lot easier than Rachel Reeves

-

Banks, corporates, even the government find eager buyers

-

Issuer's first AAOIFI-compliant could appeal to more investors

-

If you want peace, financially prepare for war

-

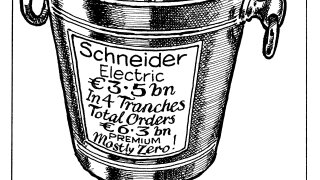

Issuer blazes through smoking hot market ◆ Deal prices through fair value ◆ Spread to senior curve 20bp inside year's other tight trades

-

◆ French issuer prints two year floater and four, 6.5 and 12 year bonds ◆ Peak demand tops €11bn across the four tranches ◆ 12 year bond attracts the largest final book

-

Records broken as World Bank Group issuers smash through new funding year

-

EDF proved that demand for ultra-long debt exists in Australian dollars but it won't last forever

-

Some EGBs could benefit from the transition to riskier assets

-

◆ Green label and capped size set up tight pricing ◆ Result is Danske's tightest tier two, beating Covid-era issuance ◆ Some first mover advantage gained

-

Senior funding there for the taking, covered bonds yet to take off — but conditions are great for all

-

Private credit is muscling in on investment grade credit. But the acid test will be whether it can compete on price