Caribbean

-

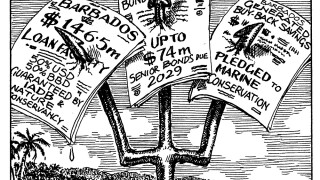

Bankers see Barbados’s debt for nature swap as the most efficient of its kind

-

IDB-guaranteed facility will help fund tender offer for some of country’s international bonds

-

Analysts say creditors likely to hold out for better terms

-

Investors say multilateral guarantee gives little comfort

-

Analysts divided on potential impact on the country’s curve

-

LM should bring upgrade for Trinidadian state-owned oil company

-

Proceeds from any new bond will be used for the tender offer on the parent company's 2026s

-

Sovereign offers attractive pricing but observers praise size

-

Caribbean sovereign has been expected in primary markets since January

-

Suriname’s debt workout has the ingredients to be a fascinating case study for sovereign restructuring. GlobalCapital spoke exclusively to the two ministers leading creditor negotiations, Armand Achaibersing (l) and Albert Ramdin (r).

-

Some 20 countries candidates for debt for conservation, says Credit Suisse sustainability chief

-

Whenever an ESG debt capital markets transaction catches the attention of the mainstream press, it tends to put noses out of joint among those who did not participate.