Canada

-

◆ Choice of three or five year tenor considered ◆ 'Intensive schedule' of investor meetings pays off ◆ Other CAD issuers likely to be 'inspired' by deal

-

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

◆ Possible record demand for first non-UK benchmark since PRA debacle in April ◆ Deal lands flat to fair value and euros ◆ Market hopes more names will follow

-

◆ TD prints largest euro deal for a year ◆ Strong demand for rare three year notes ◆ Minimal premia needed

-

◆ Five year 'would have been simple option' ◆ Building on success of World Bank ◆ Swap spreads steady despite heavy issuance

-

◆ Issuer's first euro 10 year for a while ◆ 'Exceptional investor base' built over the years ◆ Pricing tighter than OMERS and provinces in secondary

-

Issuer reaps ‘pleasant and unexpected reward’ from new NZ dollar deal

-

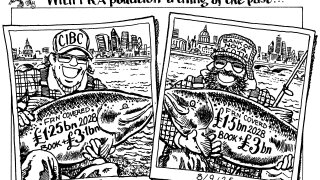

◆ First offshore deal in sterling since PRA debacle in April ◆ Canadian undersupply driving demand ◆ Euro still better despite the UK Treasury's equivalence plans

-

◆ Huge demand for second euro bond ◆ 'Remarkable' result a reflection of strong market ◆ Bond immediately performed, dragging peers tighter

-

◆ Canadian lender completes biggest euro funding since 2020 ◆ Third deal in Canadian bank series ◆ Euro proves 'attractive' for these issuers

-

◆ First euro deal since January 2024 ◆ Timing and tightening 'just right' ◆ Peer issuance provides confidence

-

◆ RBC makes fourth visit to euro senior market in 2025 ◆ Fast money sensitive to tightening ◆ Bail-in value vs other jurisdictions evaluated