Caisse d Amortissement de la Dette Sociale

-

Caisse d’Amortissement de la Dette Sociale printed a €500m tap of a short-dated note at a skinny spread over its sovereign on Thursday.

-

A French agency is set to join the European Union in tapping an outstanding euro benchmark this week, after mandating a bank for a deal late on Wednesday afternoon.

-

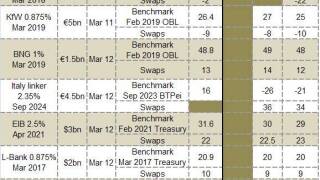

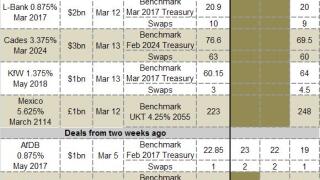

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Caisse d’Amortissement de la Dette Sociale on Tuesday sold its largest ever 10 year euro deal, buoyed by a sell-off in rates that morning. Investors piled into the deal, eager to get a piece of core eurozone SSA paper paying a double digit spread over mid-swaps.

-

Caisse d’Amortissement de la Dette Sociale is the first issuer to mandate in euros after the European Central Bank slashed its main refinancing rate and deposit rate by 10bp last week. The agency is looking to sell a 10 year deal, which is expected to attract strong demand despite the outright yield looking set to fall below 1.4%, as the deal has rarity value. It is Cades’s first benchmark size appearance in that part of the curve since last year.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week SSA Markets provides funding updates on selected French borrowers. Read on to see which borrower is nearly three-quarters done for the year already.

-

Cades took to the dollar market on Thursday, selling a rare 10 year print. The issuer was inspired to sell the tricky maturity by a strong market this week and was rewarded with almost $4bn of orders.

-

Cades and KfW were the latest issuers to add to a flood of dollar issuance on Wednesday afternoon, hiring banks for a 10 year and four year deal respectively. The European Investment Bank and L-Bank both enjoyed solid demand for benchmarks of their own on Wednesday.

-

The European Financial Stability Facility completed its €14bn funding target for the first quarter of the year with a €2bn tap of its July 2018 bonds on Wednesday. Elsewhere in euros, Bank Nederlandse Gemeenten sold a €1.5bn five year benchmark and Cades printed a €1bn tap.