Brazil

-

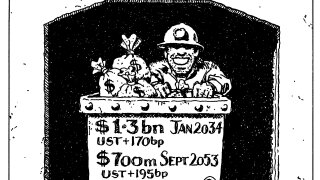

Brazilian steelmaker brings life to Latin American pipeline but few issuers likely to test waters in December

-

The sovereign secured at least 10bp of greenium

-

Brazilian issuer raises $850m amid petrochemical industry downturn

-

JBS also sells a dual-tranche as well-known names waste no time after Labor Day

-

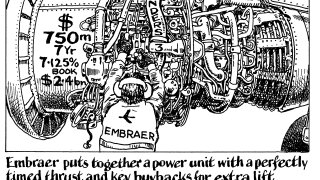

LM component supports demand as Brazilian issuer raises $750m

-

Sovereign is still working on first sustainable bond framework

-

The issue comes after a bond exchange offer and payment relief agreement from lessors

-

Big name issuers finally return but aggressive approach unsustainable as aftermarket underwhelms

-

Issuer prices with limited concession in its first deal since 2021

-

Region’s private sector returns to international bonds, with IG issuers paying minimal concessions

-

Rare Latin American corporate mandate could open a window for others

-

Eager investors appear willing to ignore hawkish signs with more borrowers likely to contemplate bonds