Bank Nederlandse Gemeenten

-

This week SSA Markets provides funding updates on key European supranationals and agencies as we near the end of the first quarter. Click here to find out which issuers have completed nearly half of their 2014 funding requirements.

-

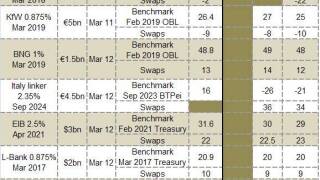

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Financial Stability Facility completed its €14bn funding target for the first quarter of the year with a €2bn tap of its July 2018 bonds on Wednesday. Elsewhere in euros, Bank Nederlandse Gemeenten sold a €1.5bn five year benchmark and Cades printed a €1bn tap.

-

The European Financial Stability Facility, Bank Nederlandse Gemeenten and Cades lined up to stuff full an already busy euro pipeline on Tuesday, after mandating banks for a series of euro deals. The issuers follow Belgium and KfW, which both attracted strong books to deals at different ends of the curve.

-

Read on to see how deals priced earlier in the year are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how deals priced earlier in the year are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Bank Nederlandse Gemeenten is set to bring the first of several expected benchmarks in dollars this week following a lull in issuance due to Chinese New Year. Other issuers are likely to wait until after a Japanese holiday on Tuesday, allowing the Dutch agency to steal a march on its competition.

-

Read on to see how benchmarks priced in January are faring in the secondary market. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how benchmarks priced in the first three weeks of the year are performing in the secondary market. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark bond as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how deals priced in the first week and second weeks of the year are faring. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark bond as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read the funding scorecard this week to see how selected European supranationals and agencies have got on in the busy first few weeks of the year.

-

SSA bankers breathed a sigh of relief on Tuesday as the first euro benchmark from a core European agency of 2014 performed well despite looking a little sluggish during the morning’s business.