Belgium

-

On Thursday, Belgian gas transmission system operator, Fluxys, successfully priced both sub-benchmark tranches of its latest corporate bond deal it had set out to sell when it met with investors earlier in the week. The 10 year tenor was the company’s primary aim, but it was also willing to explore reverse enquiry for a 15 year tenor.

-

The European Banking Association (EBA) and the European Securities and Markets Authority (ESMA) published guidelines this week for how financial institutions should make their management suites more diverse — but have declined to lead by example.

-

A glut of short end dollar issuance this week is set to ramp up on Thursday, after a pair of rare names in the currency mandated on Wednesday. The trades will follow a strong showing from Finnvera after the Finnish agency — also an uncommon name in dollars — printed its largest ever trade in the currency.

-

Montea, the Belgian real estate investment trust focused on logistics warehouses, has raised €68m, after its one for six rights issue was 91% subscribed, and a rump sale disposed of the rest this morning.

-

Strong short end dollar demand led a host of issuers to print tight deals this week, including one debut. Investor appetite is expected to stay strong, but bankers are sceptical that there will be much supply.

-

Praesidiad, a Belgian perimeter security company, launched the term loan for its acquisition by private equity firm Carlyle on Monday, in what was a busy week for the market. More than €2.5bn of loan deals have been launched in the past four days.

-

Barry Callebaut, the Belgian-French chocolate company now headquartered in Switzerland, has joined the growing, but still very new, trend of companies taking out syndicated loans with margins tied to their sustainability performance.

-

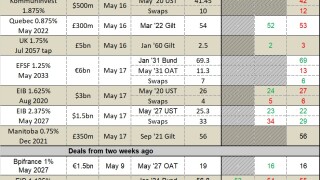

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

-

The euro market, despite a week shortened by European holidays, churned out a steady diet of solid deals. The French election, credited with triggering the rally, is growing more distant but the bid for quality fixed income paper remains as healthy as ever.

-

The Flemish Community’s second ever outing in the public debt market raised €1.25bn over two tranches, pulling in large books and setting the final spread 4bp inside guidance on one of the legs.