BBVA

-

Market participants expect that bank debt issuance activity will slow down in anticipation of earnings season over the next few weeks. But deal arrangers suggest banks will still be keen to access the primary market during this period, should conditions remain favourable.

-

Each week, Keeping Tabs brings you the very best of what we have found most useful, interesting and informative from around the web. This week: liquidity in the age of central banks, making bank capital green, and US fiscal stimulus.

-

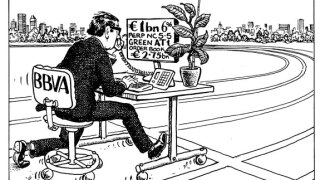

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-

-

Bankinter continued the additional tier one (AT1) supply spree on Thursday, becoming the third issuer to launch this type of bond this week and receiving praise for the 6.25% coupon it achieved.

-

Some parts of the market are talking about the benefits of ultra-short, money market debt that has a sustainability theme, while on Tuesday BBVA issued a perpetual green bond, albeit with a call. The viability of both these forms of debt shows that the common perception of green bonds is not quite true.

-

Conditions in the primary FIG bond market have improved of late, tempting European issuers to bring subordinated trades. Rabobank made an appearance this week, adding to a flurry of trades in the format.

-

BBVA became the first financial institution to issue green debt in additional tier one (AT1) format on Tuesday, launching a bond with a 6% coupon. The Spanish lender left no premium on the table, according to some market participants.

-

Takeda Pharmaceutical was the standout issuer as US high grade corporate bond issuance ground to a halt this week, ahead of the July 4 holiday.

-

CaixaBank attracted plenty of demand for its first Covid-19 bond on Wednesday, printing a €1bn deal at a spread that was through the fair value implied by its outstanding securities.

-

European banks jumped into the US dollar market this week, with some issuers clocking up huge savings in the currency versus what their home markets could offer.

-

Bagshaw heads to HSBC, Deutsche replaces him — Citi's Kemp retires — Karolev moves to JP Morgan