BayernLB

-

◆ Pricing comes tighter than where LBBW and Helaba last issued similar SNP floaters ◆ Deal will enhance BayernLB's credit rating

-

BPCE, Mediobanca and BayernLB all delivered on mandates revealed last week

-

Mediobanca, BayernLB, BPCE reserve primary market spots as others are expected to bring a deluge of issuance next week

-

◆ Key investors snub senior non-prefs ◆ Real money buyers seemingly happier with lower credit, higher spread ◆ Landesbank Berlin non-benchmark deal gets better reception

-

◆ The 'powerful technicals' driving success in unsecured issuance ◆ Nykredit takes advantage with 'solid' deal ◆ German issuer the only other benchmark deal being marketed

-

Stadtsparkasse München to test demand for five year Pfandbrief

-

◆ Deteriorating market conditions made worse by investors demanding higher premium ◆ 'Wise' decision to print after two days of calls ◆ Shawbrook sells private placement-like tier two in sterling

-

◆ Pent-up demand supports issuer set to regain IG ◆ Concession was 0bp-10bp, below what eurozone periphery smaller issuers have paid ◆ BayernLB chooses extra day of marketing for tier two

-

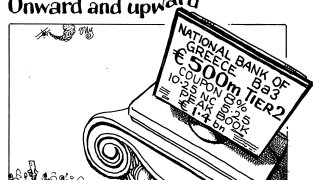

◆ Both deals are expected to price as early as Tuesday ◆ Unlikely to compete for demand due to differing ratings and buyer bases ◆ NBG will print the first Greek bond after Moody’s rating upgrades

-

◆ Strong final outcome gives hope to others ◆ Core issuers aim for investors' 'sweet spot'◆ Bookbuilding shows buyers having the 'upper hand'

-

◆ Investors attracted to higher spread sales ◆ Pair need 15bp concession to cross the line

-

Two from last deal not working on new issue