Barclays

-

Market all but certain US rates will be on pause this week, while looking for clues for September

-

Analysts warn of spillover from potential sovereign downgrade, threatening regulatory treatment and spreads of agency bonds

-

Co-CEO leaving is first high profile departure since takeover

-

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

◆ Record book for an EIB EARN ◆ Demand supports ‘comfortable’ 3bp tightening ◆ Positive backdrop as SSA spreads perform in secondary

-

◆ LatAm development bank adds to funding toolkit ◆ Patience is virtue as issuer waits out tariff storm ◆ Book ended up 6.4 times covered

-

◆ Large deal kickstarts FY 2025-26’s linker programme ◆ Shorter maturity caters to investor demand ◆ ‘Consistent, business-as-usual approach’ celebrated by markets

-

Losses will affect all departments and regions

-

‘Compelling and unique’ opportunity leads to record demand for new vaccine bond

-

◆ Canadian issuer last appeared in euros in 2022 ◆ ‘They came back with a strong print’ ◆ Large book makes allocation a challenge

-

◆ Deal attracts largest SSA book since Feb ◆ Issuer follows usual pattern ◆ Strong macro, interesting RV

-

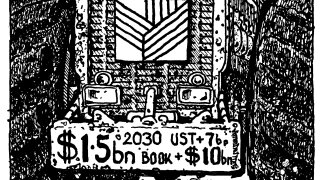

◆ Biggest book for Rentenbank in any currency, according to lead ◆ Agency raises $1.5bn ◆ Sets stage for more dollar issuance