Bank of China

-

Four Chinese local government financing vehicles courted dollar investors on Tuesday, raising $870m between them.

-

The Republic of the Philippines focused on investors keen to buy long-dated bonds by selling a dual tranche dollar deal this week. The $3bn trade featured a chunky $2.25bn 25 year portion that easily trumped the sovereign's last similar outing.

-

Chinese local government financing vehicle Linyi City Construction Investment Group Co nabbed $300m from an offshore bond on Monday.

-

Zhongyuan Yuzi Investment Holding Group Co has become the first Chinese local government owned firm from Henan to price an offshore bond since the high-profile default of another issuer from the same province last November.

-

Altana, a German speciality chemicals company, has moved its main bank line to a sustainability-linked structure, with the borrower negotiating a margin in line with its pre-coronavirus pandemic levels.

-

Hong Kong-based Bank of China Group Investment has broken a year-long absence from the Panda bond market, pricing a three year deal this week for refinancing.

-

Senior and covered bond plans were flowing into the deal pipeline on Monday, with issuers keen to buck the softer tone and print before the start of the summer break.

-

Asia’s dollar bond market is set for another relatively muted week for deal flow as pressure on China’s real estate industry and the US Federal Reserve’s surprisingly hawkish tone recently slow issuance.

-

Hong Kong-based Bank of China Group Investment is preparing to sell Rmb2.5bn ($391m) of Panda bonds, returning to the onshore market after more than a year.

-

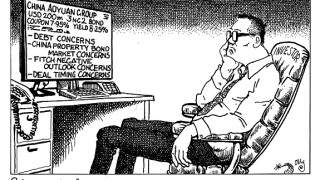

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

Germany’s BMW sold two Panda bonds in China’s interbank market on Thursday, tapping onshore liquidity with a publicly syndicated deal for the first time. The transaction was also a rare public outing from a ‘real’ Panda issuer.

-

Bank of Communications Financial Leasing Co used a sustainability label for its new $500m three year bond.