Bank of America

-

Second largest outing from a single deal for the WB since 2021

-

Nordic supra plans to keep up pace of issuance into the summer

-

World Bank and OFTF among SSAs filling the dollar pipeline

-

'Patchy' SSA issuance expected in sterling after sparse few weeks

-

'Very encouraging' for Q2 as investors pile into euro books

-

MPS has been on a strong run since its last recap, aided by rising interest rates in the eurozone

-

Dollar SSA issuance to build, though euros offering tighter pricing for many

-

-

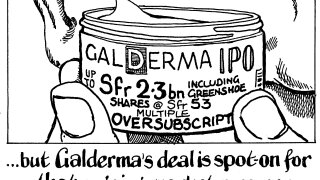

The biggest IPO of 2024 so far in Europe has delivered a welcome bounce in the aftermarket

-

The final size of the base deal will be Sfr2bn after the IPO was priced at the top of the range

-

Books for the European sovereign’s €5bn deal were ‘sizable for a linker’

-

The biggest IPO of the year so far in Europe is multiple times covered, according to sources