Top Section

Top Section

India is on track for a record year of IPOs. Global tech giants continue to plough capital into a fast-growing consumer economy that is investing heavily in ensuring it’s a major player — along with the US and China — in an AI-first world

◆ Deal finds demand despite arrest of South Korea's president ◆ High single digit concession left for investors ◆ Leads added spread to calm concerns

South Korean policy lender kickstarts 2025 funding following a month of political chaos

More articles

More articles

More articles

-

Volumes will pick up, say bankers, but volatility will never be far away

-

COP28 emphasised funding needs of developing countries adapting to climate change

-

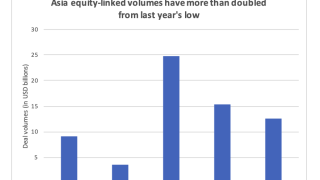

MicroPort deal brings hope of China revival, which will be needed if volume is to keep rebounding from 2022 low

-

Mongolia draws $4bn demand for $350m deal, the Philippines raises $1bn at a negative concession and investors ‘scramble for allocations’ on two China bonds

-

Opportunities abound in private credit, but there’s a mismatch between funds raised and deal availability

-

‘Stars align’ for issuers to return to bonds amid optimism that the US Fed may be done with rate hikes for now

shared comment list