Top Section

Top Section

India is on track for a record year of IPOs. Global tech giants continue to plough capital into a fast-growing consumer economy that is investing heavily in ensuring it’s a major player — along with the US and China — in an AI-first world

◆ Deal finds demand despite arrest of South Korea's president ◆ High single digit concession left for investors ◆ Leads added spread to calm concerns

South Korean policy lender kickstarts 2025 funding following a month of political chaos

More articles

More articles

More articles

-

Other countries likely to follow with mandatory plans in coming years

-

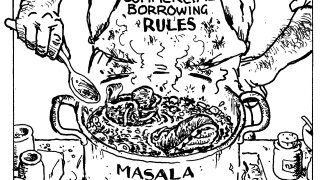

The Masala market has been languishing in a slough of bureaucracy

-

Credit Suisse says the transaction is designed to release capital and achieve significant risk reduction for the group

-

Faltering profits and competition from Singapore have pushed the bourse to tailor bespoke rules for non-profitable tech companies

-

As the risk outlook worsens, it is important that both groups join forces to help securitization stay buoyant

-

Market is growing bullish about southeast Asia’s IPO market, with pipeline building slowly but steadily

shared comment list