Top Section

Top Section

India is on track for a record year of IPOs. Global tech giants continue to plough capital into a fast-growing consumer economy that is investing heavily in ensuring it’s a major player — along with the US and China — in an AI-first world

◆ Deal finds demand despite arrest of South Korea's president ◆ High single digit concession left for investors ◆ Leads added spread to calm concerns

South Korean policy lender kickstarts 2025 funding following a month of political chaos

More articles

More articles

More articles

-

Nayuki Holdings, a Chinese teahouse chain, is set to launch its Hong Kong IPO on Friday, according to a source close to the deal.

-

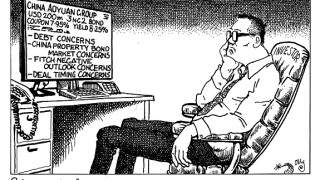

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

VPBank Finance, the consumer finance arm of Vietnam Prosperity Joint Stock Commercial Bank, has returned to the loan market just four months after its last deal. But this time around, it has brought together a diverse mix of lenders to run its fundraising — a rarity for transactions from the country. Pan Yue reports.

-

Credit Suisse has promoted two veteran bankers in its Greater China private banking business.

-

Shanghai Junshi Biosciences has raised HK$2.56bn ($330.5m) in equity capital from a placement of shares that drew a solid response from investors both during wall-crossing and bookbuilding.

-

Red-chip issuer China Everbright Environment Group has raised Rmb2bn ($313m) from a Panda bond, ahead of a planned outing by sister company China Everbright Limited this week.

shared comment list