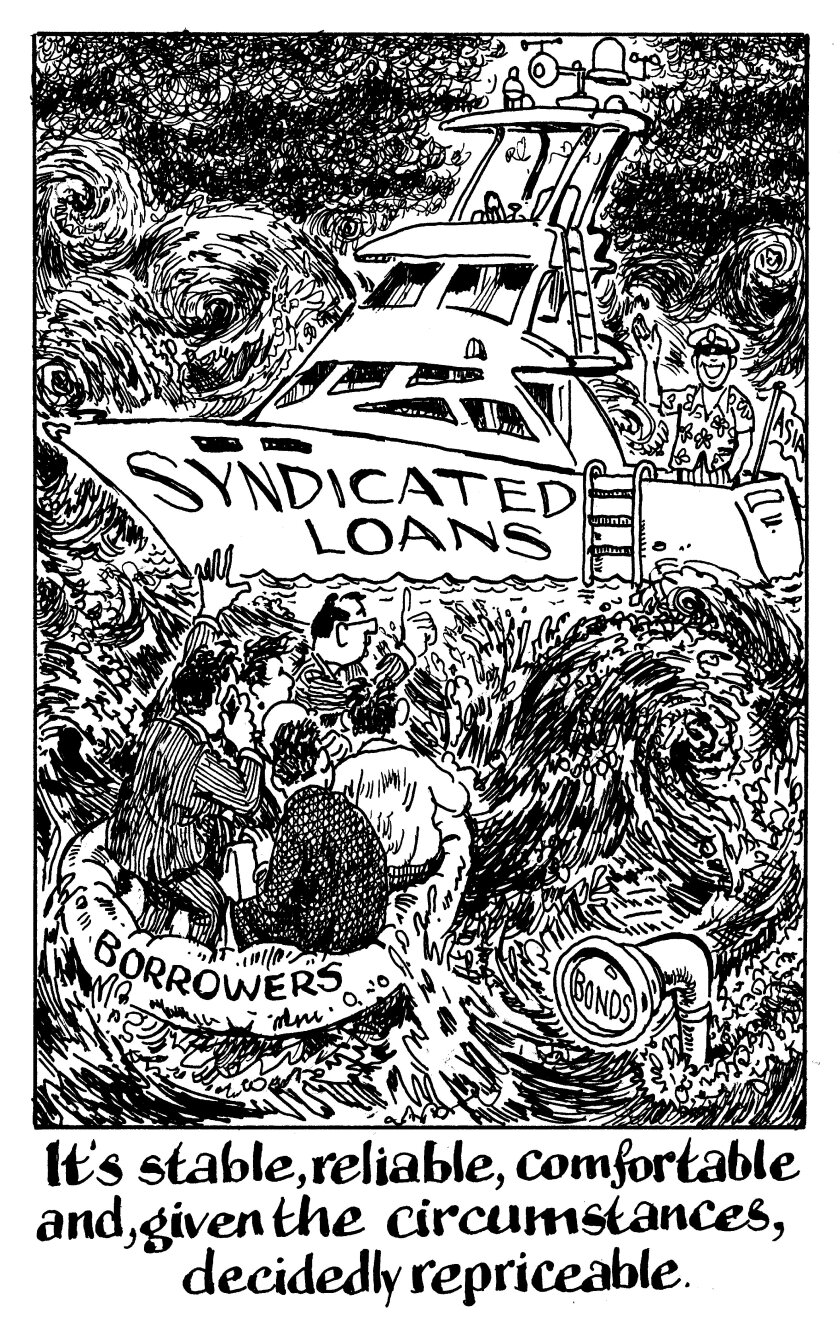

Asia’s syndicated loan market held its own this year, amid a sell-off in the region’s US dollar bond market, waning risk appetite, a higher interest rate environment, and concerns about inflation and growth.

G3 currency lending in Asia ex-Japan stands at $77.2bn from 159 deals so far this year. This volume exceeds the $74bn seen this time last year, while deal numbers are slightly lower than the 172 seen in 2021, according to Dealogic data.

By comparison, G3 bond volumes in Asia ex-Japan tumbled to $176.7bn — a drop of about 45% year-on-year — while deal numbers also fell 32%, according to Dealogic.

The evisceration of the debt market is due to a host of factors: rising US Treasury yields making funding more expensive; geopolitical volatility; growth concerns, including China’s zero-Covid approach; a property crisis in mainland China; and rampant defaults and missed bond payments by Chinese developers.

On the other hand, loan bankers who have long touted the syndication market’s benefits have been vindicated. This year saw its liquidity, stability, resilience and relatively slower reaction time to global market upheavals, come to the fore.

Fewer options

There’ve been challenges, of course. Syndicated loans are taking much longer to close as participating banks do more due diligence. And, as high-yield names shut out from the bond market are turning to bank lending, lenders are becoming more selective about the credits they’ll lend to and are demanding higher prices on deals.

One of the appeals of Asia’s loan market is the razor-thin margins many borrowers can get away with. While this year’s interest rate hikes by the US Federal Reserve are making bonds more expensive for issuers, in Asia, upticks in loan pricing are slow coming.

Bankers say that despite many big loan houses experiencing spikes in their funding costs during the second quarter, many did not pass them to borrowers due to fears about missing out on deals.

For instance, the secured overnight financial rate (Sofr) rose from 0.3% on April 1 to 1.5% by the end of June, and on Monday it was at 3.05%. Recently, there have been marginal rises in the pricing of some Asian US dollar loans that are in line with Sofr’s rises, but they haven’t been meaningful enough to suggest a broader repricing is happening.

Opportunity costs

But such a repricing could do good for the syndication market. Currently, bookrunners get lower returns unless they secure ancillary business from borrowers.

With loans becoming more popular, as borrowers have access to fewer funding tools, banks have more pricing power that they could take advantage of. Slightly higher loan costs are unlikely to deter borrowers that are shut off from other fundraising sources, especially those that need to refinance debt. 2022 has already seen some companies ditch the US term loan B market due to volatility and turn to Asia’s bank lending market.

Of course, Asia’s loan market isn’t homogenous. And lenders take a binary attitude towards borrowers, syndicating stable names while offering alternative solutions to riskier ones.

But now Asia’s banks are in a position where they can demand higher returns for their underwriting risks. They should find their voice and do so.