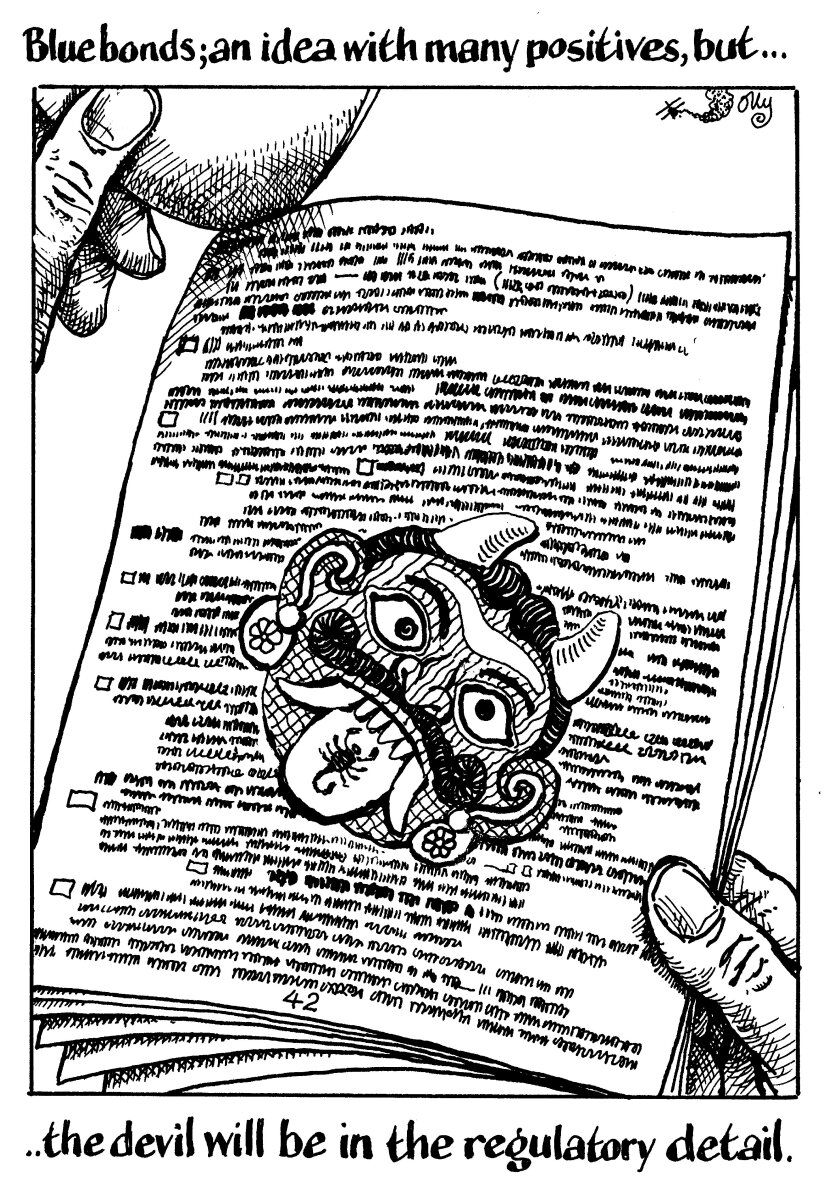

The Indian regulator’s proposal to expand its ESG debt market to blue bonds and align standards with those internationally sends the right signals, but will only be impactful if done right.

The Securities and Exchange Board of India, the country’s market regulator, published a consultation paper on green and blue bonds at the end of last week. It is seeking feedback on a host of things, but a few are particularly notable: expanding the definition of green bonds; aligning India’s ESG market with global standards, including by cutting compliance costs for green debt issuers, and — perhaps most notably —introducing blue bonds.

Sebi’s move is laudable. After all, like the rest of the world, India's ESG debt market has grown exponentially over the past few years.

Indian corporations raised nearly $7bn from ESG and green bonds in 2021, versus $1.4bn in 2020, and $4bn in 2019. Globally, green, social, sustainable and sustainability-linked bonds accounted for over 12% of the global bond market last year, compared to roughly 2% in early 2018.

But this year, deal flow has tumbled across both ESG and conventional bonds, as headwinds like rising US interest rates, volatile market conditions, fears of recession, and inflation all take a toll on capital markets.

Against this backdrop, Sebi timing is excellent. Unveiling the potential of blue bonds, for instance, in the middle of summer allows market participants time to digest features of such deals before the first raft of bonds emerge.

Blue bonds are those focused on putting money towards activities related to oceans, seas and coasts. They are certainly suitable for India, which boasts 7,500 kilometres of coastlines and 14,500 kilometres of navigable inland waterways. This means blue bonds sold by issuers can go towards a raft of important purposes: oceanic resource mining, sustainable fishing (fishing is a key source of livelihood for many in India); coral preservation; and reducing water pollution. India has even hinted at labelling some bonds as yellow, if they are aligned with solar power.

Another proposal from Sebi is aligning its green bond framework with that of the International Capital Market Association (ICMA).

While markets like China and the European Union have a common taxonomy on assets eligible to be funded through green bonds, India does not have such standardisation. Sebi hopes to expand its green bond guidelines to alternative debt formats like green revenue bonds, green project bonds and green securitized bonds, all of which are included in the ICMA principles.

Aligning its ESG market with the global market makes sense. Most of the green bonds issued by Indian borrowers so far are listed on offshore exchanges, given lack of demand for such deals from Indian investors and attractive pricing overseas. By end of June, only 14 issuers had sold green bonds under Sebi’s framework, worth about $500m.

Bringing its own standards on par with that used globally is a step in the right direction and will help avoid greenwashing among borrowers. It will hold them to stricter standards — both from a post-issuance disclosure and reporting angle, as well as finding suitable projects to park their proceeds.

But the launch of blue bonds, if it happens, will have to be done carefully.

While segmentation of the host of ESG-linked bonds is useful for more transparency and clarity for investors, Sebi needs to balance opening a new sustainable financing venue and avoiding de-emphasising its flourishing green bond market.

While blue bonds are considered a sub-sect of green bonds, by asking issuers to explicitly label their fundraising as 'blue' risks forcing them to deploy money to much narrower use of proceeds when compared to labelling them green. It is worth remembering that every borrower that issues green bonds can already technically issue blue bonds from their existing green framework.

India will also have to tackle some inherently domestic issues around blue bonds.

The Indian peninsula is surrounded by many water bodies, while within the country there are numerous water sources present in remote areas. This makes identifying polluters and problems trickier, posing a challenge to issuers around making disclosures about how their blue bonds were used.

It also doesn't help that the Indian sovereign has never before issued a public bond, ESG linked or otherwise, despite hinting at the possibility many times before. If India wants its financial institutions and corporates to take climate change and the adverse effect on ocean life seriously, and tap markets to fund climate efforts, it needs to lead the way. A clearly-labelled international sovereign bond will pave the way for others.

Sebi deserves credit for honing in on the importance of strengthening and protecting India’s water ecosystem. Depending on the feedback it gets from the market, it’s work, however, may just be beginning.

Sebi is taking feedback on its plans until the end of the month.