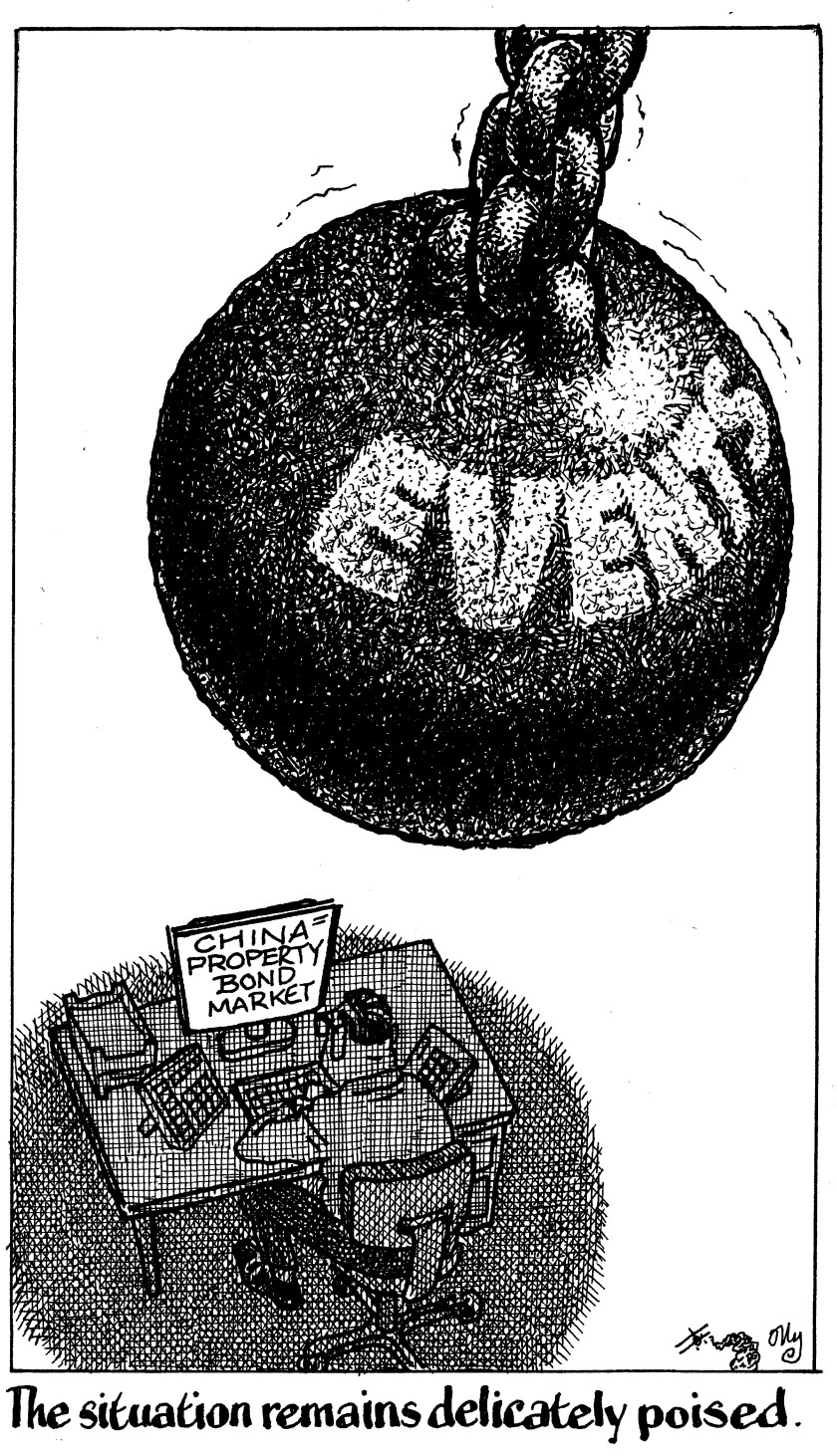

A recent rebound in the secondary market performance of Chinese property bonds belies the fact that bigger troubles are brewing for offshore investors.

A lot has been written about the health (or the lack thereof) of China’s property bond market in the past few months, since China Evergrande Group, the world’s most indebted developer, showed signs of financial distress. The most recent development is a rumour that Beijing is likely to ease access to real estate firms’ escrow accounts to help them refinance looming maturities.

That news gave a shot in the arm to property dollar bonds over the past few days — after largely trading under 70 cents to a dollar this month — raising optimism that more loosening may be on the way, which could be the light at the end of the tunnel that many investors have been looking for.

But they may have another thing coming.

It is no secret that some of the problems of the sector are more policy-driven than credit centric. Whether it was the government’s three red lines measure to curb debt, or the recent haphazard control of escrow accounts by overzealous local governments, the ill-timed policy measures have pushed the highly leveraged sector into the doldrums.

Given the size of the sector, its problems are significant. Real estate investment is estimated to account for about 15% of China’s GDP, which rises to about 25% if including upstream and downstream sectors, according to JP Morgan estimates.

This means any hit to the sector could have big repercussions to the economy, issuers and capital markets, given property firms are among the largest sellers of high yield dollar bonds in Asia.

Investors who could exit in time before the fall of China Evergrande Group in September 2021 can count themselves lucky, as the stress in the industry has only spiralled since. Many investors are sitting on large mark-to-market losses; the only active buyers left are said to be US hedge funds, which pick assets at discounted levels that are unpalatable to many bondholders.

Debt swaps in play

Developers continue to face severe liquidity crunch. This has made debt exchanges a popular choice, albeit at a likely big cost to investors.

Debt swaps save developers from imminent defaults as they provide an immediate extension of debt and allow the company to use the cash for other important purposes. However, these debt swaps come with consent solicitations to dilute a host of bond covenants — a move that could substantially increase risks for investors in the future.

China high yield bond covenants typically cover limitation on debt, liens, sale and leaseback, dividend distribution, asset sales and capital stock. GlobalCapital Asia understands a significant loosening of these covenants is taking place in the garb of debt exchanges.

Assuming the developers executing debt exchanges remain in trouble after their extension period runs out, a further restructuring of debt may be on the cards.

The result? More pain for investors in the form of low recoveries or perhaps even no recovery of their investment.

As most property developers issue dollar bonds through offshore subsidiaries, bondholders may at best have access to shares of these issuing entities, which are stepdown subsidiaries of onshore parents holding the real assets. Due to this structural subordination, in the event of default, offshore investors will likely be treated as equity holders instead of creditors — making any recovery risky.

Given president Xi Jinping’s government’s thrust on common prosperity, there is ample reason to believe policy measures could continue to be piecemeal and just enough to keep the sector afloat with a focus on resolving the woes of homeowners.

This means a bigger contagion risk is a real possibility, which will translate into more insolvencies. If including the vast amount of hidden debt many firms likely hold, and the situation becomes even more precarious.

Recovery values

All this shows that things may become worse for bond investors before they get any better — despite the recent bounce back in secondary bond prices.

It doesn’t help that China has long had a reputation for its opaque functioning, with even the most high-profile debt restructurings clouded under mystery.

Take for example the case of Evergrande, which is saddled with more than $300bn in liabilities.

Offshore bondholders have already expressed their frustration over the black box recast of the developer and the “opaque decision-making” around the debt restructuring, which is being led by the Chinese government.

Although Evergrande this week urged offshore noteholders not to adopt an aggressive legal action over repayments and instead sought more time to put together its plan, investor angst is understandable. After all, rumours are circulating that under Evergrande’s plan, likely to be unveiled by March, offshore bondholders could have a potential recovery of as low as 10 to 20 cents.

Dollar bondholders have always been treated as second cousins to onshore bondholders and local creditors due to structural subordination. Just take the example of Peking University Founder Group. In mid-2020, the beleaguered firm’s debt administrator said it won’t recognise dollar bonds with a keepwell deed and deed of equity interest purchase undertaking, impacting holders of about $1.7bn of its debt. A keepwell structure had long been popular with Chinese bond issuers.

Dollar holders of Chinese property bonds should beware.

In any case, for any debt recast to be successful, a few factors are important.

For instance, a distressed company should be able to function as normal in order to keep generating cash flows. Given the tight control on developers — both official and unofficial — business as usual is unlikely any time soon.

Another factor is the willingness of creditors to arrive at an amicable solution. Here too, the odds are stacked against companies, as investor faith has been shaken multiple times due to unexpected hidden debt disclosures, especially involving onshore debt such as trust loans

That leaves access to capital markets, which is also out of developers’ reach.

The best way to turn the fortunes of the sector will be for Beijing to actively engage with all stakeholders in an as transparent a way as possible. The industry’s woes are large — meaning any turnaround plan should be equally impactful to gain investor confidence and align China’s restructuring practices with international standards.

Until that happens, the China property sector will remain in pain — as will investors.