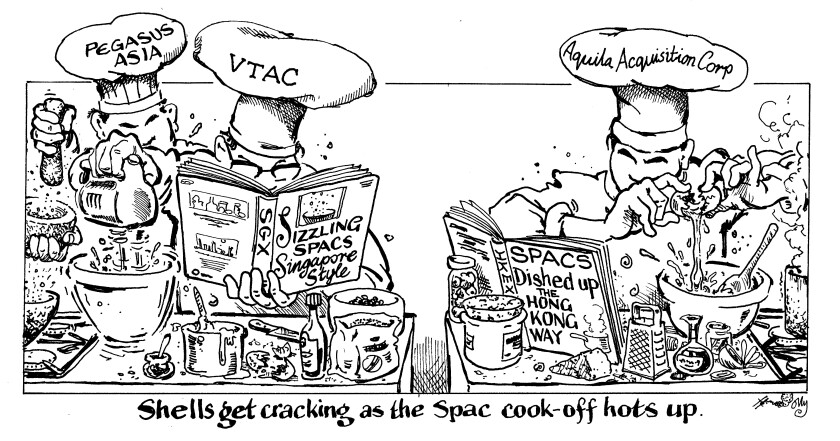

The Singapore exchange saw its first Spac list this week, while the Hong Kong bourse had its maiden Spac IPO application as the two markets race to capture a share of this new asset class in the region. More blank cheque firms are on the way, but a boom in the product may be unlikely, said bankers.

Spacs have been available in the US for nearly two decades. They are effectively shells listed to raise funds for the sole purpose of acquiring a business, known as the de-Spac target.

There was a surge in the popularity of Spacs in 2020, which included Asia-sponsored vehicles. The vast majority of the deal flow has always been in the US. But Aquila Acquisition Corp set the ball rolling for the Hong Kong Stock Exchange’s first listed Spac on Monday, filing a draft IPO prospectus with the bourse.

In Singapore, Vertex Technology Acquisition Corp (VTAC) listed on Thursday following a S$200m ($148.6m) IPO, becoming the first Spac to trade on the SGX. It is sponsored by Vertex Venture Holdings, a venture capital firm backed by Singapore sovereign wealth fund Temasek Holdings.

The city-state’s second Spac was set to debut on Friday following its successful S$150m fundraising. Pegasus Asia’s sponsors include European asset manager Tikehau Capital and the family office of Bernard Arnault, billionaire chief executive of French luxury fashion group LVMH.

Hong Kong and Singapore have long competed in the capital markets. For the business of blank cheque companies, it was no different.

Both began establishing Spac frameworks in earnest towards the end of 2020 and in 2021. The SGX came out first in September last year and the HKEX followed, with its rules becoming effective on January 1.

But it is uncertain whether there will be much competition between the Spacs listed on either exchange.

HK vs Singapore?

The Spac backers, known as promoters in Hong Kong and sponsors in Singapore and the US, will likely be looking at different directions, said multiple equity capital markets bankers.

“We don’t believe there will be direct competition between Singapore and Hong Kong Spacs, but there could be an overlap in the de-Spac targets,” said Johnson Chui, co-head of Asia Pacific equity capital markets at Credit Suisse. “First and foremost it is about which exchange is more fitting for the target.

“There are pros and cons for each listing venue. But there could be an overlap where it makes sense for the target to list on both exchanges.”

Shells listing in Hong Kong are expected to be looking for an acquisition opportunity in China, whereas Singapore Spacs are likely to cast a wider net around Asia Pacific.

“My sense is that if someone is setting up a Hong Kong Spac, it is generally going to be for a Chinese target,” said Rob Chan, head of Asia Pacific equity-linked origination at Citi. “Singapore listed Spacs are more likely to explore acquisition opportunities across Apac.”

It is natural that companies with ties to China will be targets for HKEX-listed Spacs, said Chui, “because those are the companies that have listed and done well in Hong Kong”.

Singapore’s VTAC Spac plans to acquire a business that has a “core technology focus, highly differentiated products and scalable business models, with the aim to improve people’s lives by transforming businesses, markets and economies,” according to an exchange filing. Pegasus Asia is targeting a business in a disruptive, new economy sector in Asia Pacific, according to its IPO documents.

Aquila Acquisition Corp, on the other hand, is targeting China’s new economy sectors, specifically green energy, life sciences, and advanced technology and manufacturing companies.

Aquila is backed by promoters CMB International Asset Management and AAC Management Holding. The former is wholly-owned by a CMBI, the international arm of China Merchants Bank.

It is the first of a pipeline of blank cheque companies coming to Hong Kong, said Chan: “There is a backlog that has built up for Hong Kong Spacs, some of which were planning on listing in the US.

“Some promoters that had originally prepared for issuance of a US Spac, focused on Chinese acquisition targets, have switched gears and are now focused on Hong Kong.

“I would expect over the course of the next month to see a lot more filings.”

Steady, high quality

However, neither Hong Kong nor Singapore is expecting a rush of Spac listings akin to the US market. One reason? That was not the objective from the outset.

“When the Singapore regulator was introducing the rules, we understood that its primary objective was not a flurry of Spac IPOs like in the US,” said Credit Suisse’s head of Southeast Asia ECM, Ho Cheun-Hon. “What they want to see is Spacs being a new conduit for high quality listed companies on SGX over time.”

Hong Kong has introduced Spacs to stay competitive, but it is looking for quality over quantity, having historically dealt with sub-standard companies taking advantage of reverse listings through unofficial shells, said Matthew Puhar, partner at international law firm Akin Gump Strauss Hauer & Feld.

“The Hong Kong exchange has always been against cash shells on the market because they think they encourage speculative trading based on rumours about what company will be acquired,” said Puhar. “Over the years that has tended to attract some low quality acquisitions, which meant shareholders did not do well.

“It is practically impossible to do a reverse listing onto the exchange because that would be avoiding the exchange’s review of the listing suitability of the company.”

But Hong Kong ultimately allowed Spacs to get a slice of the huge increase in the product overseas. “These exchanges are businesses and they want to be competitive,” said Puhar.

However, “Hong Kong wants to maintain a high standard”, he added. “It has a deeper market and, by size and quality of companies, it is in a different league compared to Singapore”.

The initial framework proposed by the HKEX was considered conservative and less attractive than those introduced by the SGX. In the final revision of the rules, Hong Kong relaxed some restrictions, such as reducing the minimum number of Spac investors from 30 to 20. But its regulations have nonetheless been labeled as tougher than the SGX.

Singapore allows retail investors to participate in Spac transactions, while the HKEX has limited Spacs to professional investors in both the IPO and secondary market trading.

Also in Hong Kong, when promoters identify a target business, before making the acquisition they must carry out a so-called private investment in public equity (Pipe).

A Pipe investment means a second, but private, funding round, which serves as a validation for the proposed acquisition. Pipe investments are not mandatory in Singapore or the US.

Spac listings also go through the same application process as an IPO in Hong Kong. CMBI Asset Management has appointed Morgan Stanley and its parent CMBI as the sponsors for its deal.

‘Novelty’ factor

Aquila’s IPO will comprise class A shares and listed warrants. The shares will be offered at HK$10.00 ($1.28), while an undisclosed number of listed warrants will come with each IPO share. Following the listing, the warrants can be converted into class A shares as long as the average close for the previous 10 trading days before conversion was at least HK$11.50.

Aquila’s prospectus does not specify the number of shares in its float, but under the new regulations, Spacs must have a minimum fundraising amount of HK$1bn. In comparison, Singapore requires a minimum market capitalisation of S$150m.

While the strict rules in Hong Kong make Spacs seem somewhat unattractive, they still offer a company various appealing alternatives to a regular IPO, such as the removal of the bookbuilding and public price discovery process.

“The de-Spac target can talk about their valuation directly with the Spac promoter, who will know the valuation tolerances of its investor base,” said Hong Kong-based lawyer Puhar.

“So it is a transaction between grown-ups, rather than having to value-check via the general IPO investor market and it also avoids the need to do a public offer as part of the listing.”

Singapore’s first test cases were a success, with VTAC attracting a host of high profile cornerstones and closing its international tranche 8.8 times subscribed and retail investors placement 36 times covered.

“There is a novelty factor,” said Chan at Citi. “Investors want to invest in and see how these vehicles do, and high quality promoters will get people excited.”

Chan added: “A potential pocket of demand we have yet to explore is the extent of local and regional investor participation, apart from the global funds already investing in Spacs.”

In both Hong Kong and Singapore, a Spac’s management has 24 months to identify an acquisition target and a further 12 months to complete the deal. If it fails to meet either deadline, the investors will be refunded.

Leading Aquila is a senior team from CMBI. The Spac’s chairman and chief executive is Rongfeng Jiang, general manager of CMBI’s asset management department and a member of its investment committee.