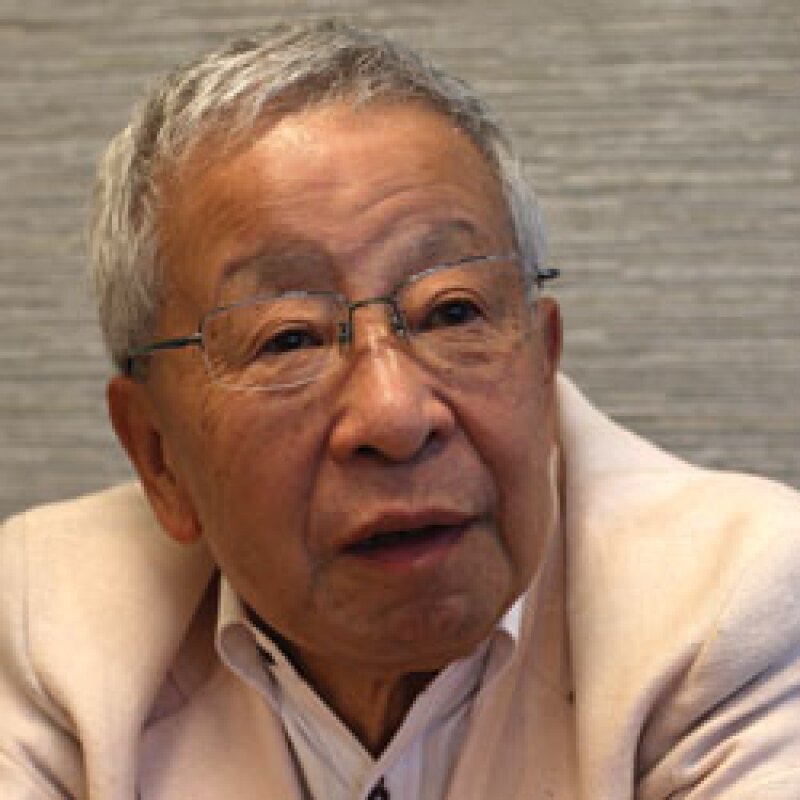

The positive impact of Japan’s unconventional monetary policy is “tapering off”, the country’s former vice finance minister for international affairs Eisuke Sakakibara told Emerging Markets.

The man known as “Mr Yen” for his ability to influence the exchange rate in the 1990s, said that while Japan’s Abenomics policies — the economic strategy of prime minister Shinzo Abe — had had a positive impact they were coming to their “final stage”. “People are worried about what comes next,” he said.

In an interview Sakakibara, who was formerly the boss of Bank of Japan (BoJ) governor Haruhiko Kuroda when they both served in Japan’s ministry of finance, gave high marks to what his protégé had since achieved at the central bank.

However he also voiced concerns over aspects of BOJ policy. Sakakibara said he was worried by the slowdown in global growth and in particular by the slowdown in emerging economies, including China.

Abenomics’ targets — raising annual growth to 3% in nominal and 2% in real terms, along with the BoJ target of achieving 2% annual consumer price inflation — has so far fallen far short of fulfilment, and the IMF has called for them to be “reset”.

Abe “and those around him” including BoJ governor Kuroda knew from the start that it was not going to be easy to achieve the Abenomics targets, said Sakakibara, who is now a professor of economics at a leading Tokyo university.

He defended the BoJ governor for his “aggressive” monetary easing that had initially pushed down the yen sharply, boosting Japan’s exports and corporate profits and Japanese share prices sharply.

But the “positive impact” of easy monetary policy was tapering off,” he said. “The yen is appreciating now,” he noted and, having fallen as low as ¥120 to the dollar after the BoJ embarked upon quantitative and qualitative easing in 2013 it would not be surprising to see it break above ¥100 to the dollar in the next three to six months.

YIELD CURVE CONTROL

The “next step [for Abenomics] could be a further easing of monetary policy and further implementation of fiscal [stimulus],” he said. “But we do not know what course will be taken, and what the impact would be.”

BoJ policies have proved highly controversial with markets since the introduction early this year of negative interest rates on corporate deposits with the central bank — and since the recent adoption by the central bank of a “yield curve control” policy.

Has the negative interest rate policy been successful, Emerging Markets asked? “I think you could say that it’s not popular among Japanese banks,” said Sakakibara.

On the BoJ policy of yield curve control, which aims to control (and raise) yields at the long end of the curve thereby enabling banks and other financial institutions to restore profitability, Sakakibara said: “It is a new approach and quite challenging.”

“I hope he succeeds,” Sakaibara said of Kuroda. “I am not criticising him — but it is not easy. There is no call to change the governor of the BoJ at this moment. I trust him and Mr Abe trusts him.”