Thanks to a combination of favourable circumstances, 2015 was the year of renminbi bonds in Taiwan, with issuance becoming a pillar of the traditionally Hong Kong-dominated offshore RMB bond market.

Firstly, the RMB had been on a nearly uninterrupted appreciation streak, which made RMB bonds promising for buyers looking to capture both coupon and currency gains.

In addition, the Financial Import Substitution programme introduced by the Taiwan Financial Supervisory Commission in early 2015, allowed local institutional investors, such as life insurance firms, to include the purchase of locally-issued foreign currency bonds in their overall domestic investment quotas.

“In very simple terms, last year the surge was due to what I call the policy bonus,” said Stephen Chan, head of the corporate finance department at Taipei Fubon Bank. "I think both investor and issuer sides took benefits from this policy imposed by the Taiwanese regulators."

This policy bonus also had positive consequences for issuers.

“The government gave a big incentive to bonds listed in Taiwan, by waiving the requirement of utilising offshore investment limit, so Taiwan lifers were willing to give up some coupon to reflect the policy benefit,” Chan said.

The regulators went a step further, by specifically allowing Chinese financial institutions to be eligible issuers in the local market.

This was also happening at a time when conversion of RMB to dollar funds through cross-currency swaps (CCS) was cost effective, making issuance appealing even for issuers not keen to gain RMB exposure.

The combination of factors proved a winning one, as deals volume in the Taiwan renminbi market rose to Rmb32bn ($4.8bn) across 51 deals from Rmb21bn and just 15 deals in 2014, according to Dealogic data. By comparison, dollar-denominated deals reached $40bn across 94 trades in 2015, triple the amount of deals and 2.5 times the volume of a year earlier.

In freefall

Despite the market providing a winning formula for both issuers and investors, the pipeline has dried up over the past few quarters.

The chief culprit is a well-known one. The People’s Bank of China decided to devalue the RMB by nearly 2% in a single day on August 11, 2015. As a result of the sudden weakening – which has continued over the past year with the RMB losing 7% of its value since then – and of the currency’s increased volatility, renminbi instruments have lost most of their shine.

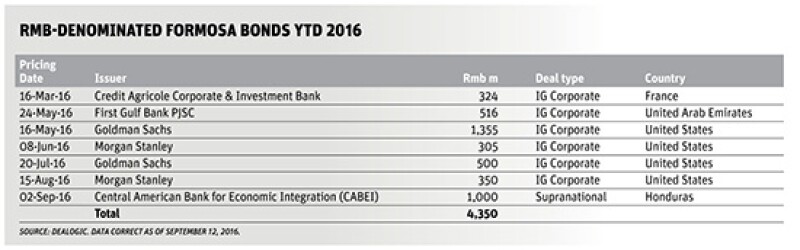

In Taiwan, this has meant that buy-side and sell-side have taken diverging views on what yield to offer to account for the currency fall. Issuance has suffered as a result, with just seven deals pricing in 2016 for Rmb5.9bn at the time of writing. Meanwhile the dollar bond market in Taiwan has already surpassed levels for the whole of 2015 with 109 deals worth $31bn priced so far.

Other factors have also gotten in the way, one of which is politics. Under the Kuomintang government led by Ma Ying-jeou, policies had been favourable to closer cross-strait ties.

But the January 2016 election of the less Beijing-friendly Democratic Progressive Party (DPP) presidential candidate Tsai Ing-wen, has meant that less emphasis is being placed on closer economic ties with China.

Market participants agree the political switch has put the brakes on the market.

“The China policy of the newly elected DPP government is not very different from the previous government but it is not as clear and transparent in the eyes of the PRC government,” said Chan. "So today the PRC authorities are holding back instead of pushing or encouraging big landmark RMB issues in the Taiwan market. Both sides are taking a wait-and-see approach."

Kevin Pu, a vice president at Yuanta Bank’s treasury department, noted there was little expectation of a quick revival in the market under current political conditions.

“Now the regulators want to contain China issues in Taiwan, economically and politically,” he said. “The [cross-strait] relationship will stay where it is for a period of time, we will have to wait and see what the new president says and what the reactions from mainland China are. I think [the relationship] will remain stagnant for a period of time, it will not be easy to improve."

Policy mis-match

Alongside a fraying of already strained political ties between the Mainland and Taiwan, China’s own policy steps have taken appeal away from the offshore renminbi market. The decision to reboot Panda bonds at the end of 2015 and the introduction in February 2016 of a reform that grants global investors’ greater access to the onshore interbank bond market have turned the attention of issuers and investors markedly towards the Mainland.

A further hit has come from dropping interest rates in China. Ten-year government bond yields, for example, have fallen by a fifth in just one year to around 2.79% as of August 27, according to Trading Economics data.

This has made Chinese issuers less keen to tap both Taiwan renminbi market and Hong Kong’s dim sum market. It is no accident that all offshore renminbi bond volumes have plummeted and not just in Taiwan. Overall issuance volume in 2016 is down 84% on last year to just Rmb14bn, according to GlobalRMB data.

“Mainland China has reduced the benchmark yields, the reserve ratio has been cut more than ten times since last year, for example,” said Yuanta’s Pu. "So the local bond yield right now is much lower than the offshore yields. So from the [Mainland] buyers' perspective, the offshore bond market is more expensive than China now."

According to HSBC data, in mid-September offshore renminbi investment grade bonds were averaging yields of 3%, while onshore the yield were 100bp lower.

Making do

The adverse conditions have created a different type of market, one that favours smaller RMB deals from financial institutions (FIs) over the larger landmark deals of 2015.

“This year there has been a wave of private placements by financial institutions as they have the additional flexibility,” said Tim Yip, head of cross-border RMB, debt capital markets, HSBC. With the RMB a much less appealing option for both issuers and buyers, movements in the CCS curve are coming strongly into focus.

"They take advantage of CCS swapping to dollars or its functional currencies for small private placements in the Rmb200m-Rmb300m range,” said Yip. "The FIs have more flexibility and when they see small pockets of liquidity they are keen to tap those immediately."

This state of affairs has been especially detrimental to corporates looking to enter the fray, as the FIs are far more agile when it comes to accessing the market.

“To an extent, the corporates need to compete with the FIs in this market, but they just cannot move as quickly as the FIs,” said Yip.

Despite the headwinds, banks have not written off the Taiwan renminbi market just yet. For while international issuers can tap the Panda bond market, the lack of a regulatory framework continues to limit issuance for the time being.

And for the Taiwanese buyers, falling rates around the world, including in China, have rekindled the offshore renminbi market’s appeal.

“The biggest buyers [in Taiwan] are the lifers and they are hungry for yields," said Yuanta's Pu. "Now that developed country yields are becoming lower and lower, so the absolute return from renminbi bonds will still be attractive for them. RMB bonds still have a market in Taiwan."

Fixing it up

A key condition for yields to drive new issuance is the stabilisation of the RMB exchange rate. Should that materialise, investors will look at renminbi deals keenly given that Taiwan dollar bond yields remained lower than those for RMB deals. For issuers, that policy bonus remains in place, making yields on renminbi deals lower than those seen in Hong Kong.

But the most important catalyst is in the hands of the regulators. Discussions are under way for a broader range of Chinese issuers being allowed to tap the market in addition to the large Chinese FIs.

"If external [conditions] become stabilised, there is a chance that PRC non-bank financial institutions and top quality SOEs/POEs can be allowed to tap the market probably under certain special conditions,” said Fubon’s Chan. "It would be very beneficial for the Taiwan government to open up."

Overall, the signs are that Taiwan’s renminbi market is ready to turn the corner.

“I think we are seeing the light of the tunnel,” said Chan. "And since Taiwan lifers are approaching their full investment ceiling, Taiwan renminbi bonds may have some pricing advantages over dim sum bonds."