The official inclusion of the renminbi into the SDR basket is on October 1. The RMB will then make up 10.92% of the five-currency basket, behind the dollar (41.73%) and euro (30.93%), but ahead of the Japanese yen (8.33%) and the British pound (8.09%).

The IMF’s director of strategy, policy and review department Siddharth Tiwari said during a conference call on September 22 that the renminbi’s inclusion was because of a series of broad reforms China made, such as allowing IMF members to freely trade in the onshore fixed income and FX markets. All this was in a bid to expand the influence of the currency globally.

There is no doubt China has made lots of progress with its financial reforms. But market participants contacted by GlobalRMB are sceptical about any material impact from the RMB’s impending inclusion in the SDR.

One of the most popular beliefs is that the renminbi’s inclusion would lead to portfolio rebalancing among the central bank community, which would result in capital inflows into RMB-denominated assets.

But Peter Kinsella, head of emerging markets economics and FX research, Commerzbank, said such a scenario is unlikely.

“One thing to note whenever we talk about inclusion is that not a lot of people actually track the SDR basket, so even if the RMB is included, it’s not like we’ll suddenly have an influx of investors scrambling to buy RMB assets,” Kinsella said.

Among the global investor base, central banks are the only ones that track the SDR basket and keep SDR as part of their FX reserves. But even within the community, not a lot do.

The total outstanding amount of SDR, for example, stood at just SDR204.1bn ($285bn) as of March 2016. That is tiny, given it translates to just 0.3% of global FX reserves.

“It’s unlikely we’ll see much impact from the inclusion given that people can already buy and sell RMB assets quite freely in the past,” Kinsella added. “And this is what we’ve been seeing given the limited amount of flows into RMB assets ever since it was announced the renminbi would be included into the basket last year.”

Depreciation pressure

Alicia Garcia Herrero, chief economist Asia Pacific at Natixis, told GlobalRMB that the bulk of the RMB purchases would have already happened since the announcement. This was because the 11-month transition period granted by the IMF was to avoid last minute buying.

As a result, it is only natural that very little flow activity would be expected when the renminbi gets officially included in the basket at the start of next month.

The issue, Herrero said, is not that very little capital inflows will occur when the RMB gets included. Instead, it is that China on a net basis is still experiencing outflows in spite of these investments.

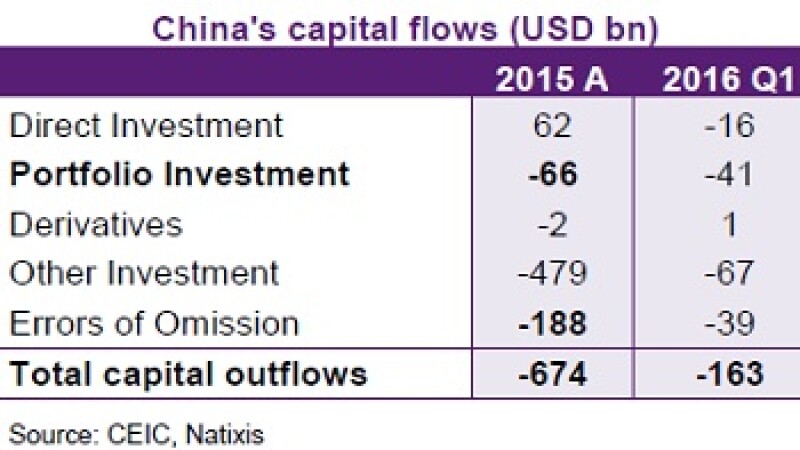

According to CEIC and Natixis data, China experienced $163bn of capital outflows in the first quarter of 2016, $41bn of which was the direct result of portfolio rebalancing.

“In sum, only if central banks increase their investment in RMB beyond the required amounts for SDR, will it make a difference for China’s thirst for capital inflows,” she said.

“The problem is that the increasingly engrained expectations of RMB depreciation are a huge drawback to entice central banks’ interest.”

The CNY has already lost 2.7% against the dollar since the start of the year and was quoted at Rmb6.6697/dollar on Tuesday afternoon. Natixis expects the renminbi to weaken to Rmb6.9/dollar by the end of 2016.