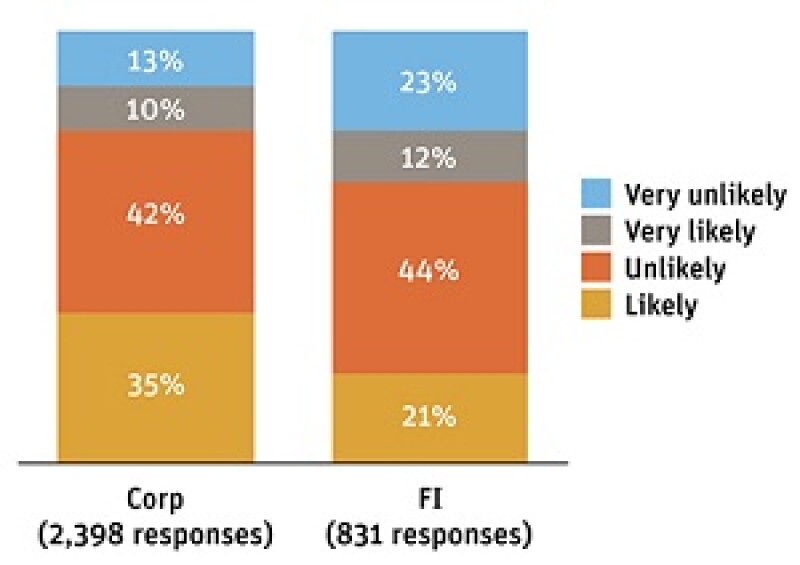

What is the likelihood of you changing your Asian regional treasury centre to take advantage of lower tax rates?

The answers to this question will perhaps give pause to Asian financial authorities who have been keen to promote the tax efficiency of their city as a way to attract more treasury centres. Most recently Hong Kong passed a bill that offers a concessionary profits tax rate to corporate treasury centres. Thailand has also provided some tax perks for companies that set up their treasuries in the country. But while the number of votes for likely and very likely for corporates (45%) and financial institutions (33%) is substantial, lower taxes is not enough to encourage the majority to up sticks and move. As the question below shows, there are a range of services that treasurers are looking for when choosing a home and it is far broader than what the taxman is taking away.

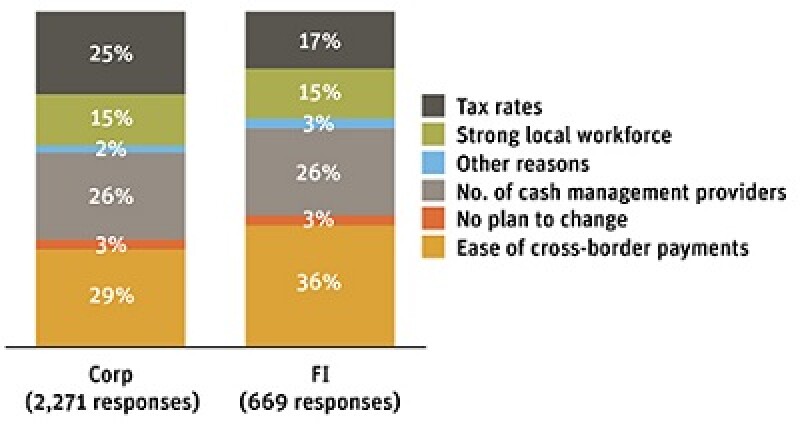

What would be the main reason for you to change the location of your Asian RTC?

Countries vying to lure treasurers take note. The ease of making cross-border payments is the number one priority for both corporates and financial institutions, according to respondents to our survey. Trapped cash remains an issue in many jurisdictions including China which has been working to ease regulations in the last few years. FIs place more importance on this factor with 36% to corporates 29% but it comes in at number one for both. In fact companies and banks are completely aligned when it comes to the importance of what drives their RTC decision. Coming in second for both is the number of cash management providers, followed by taxes in third place.

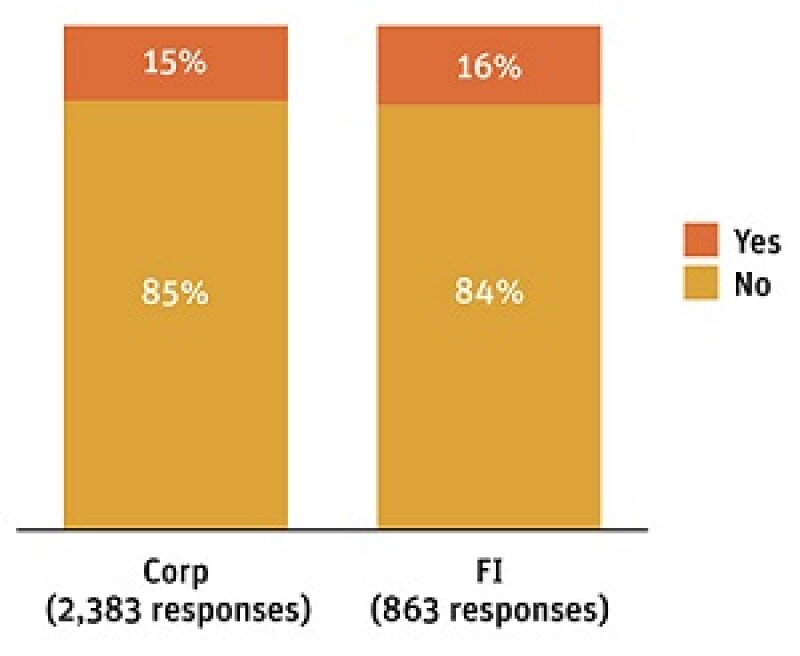

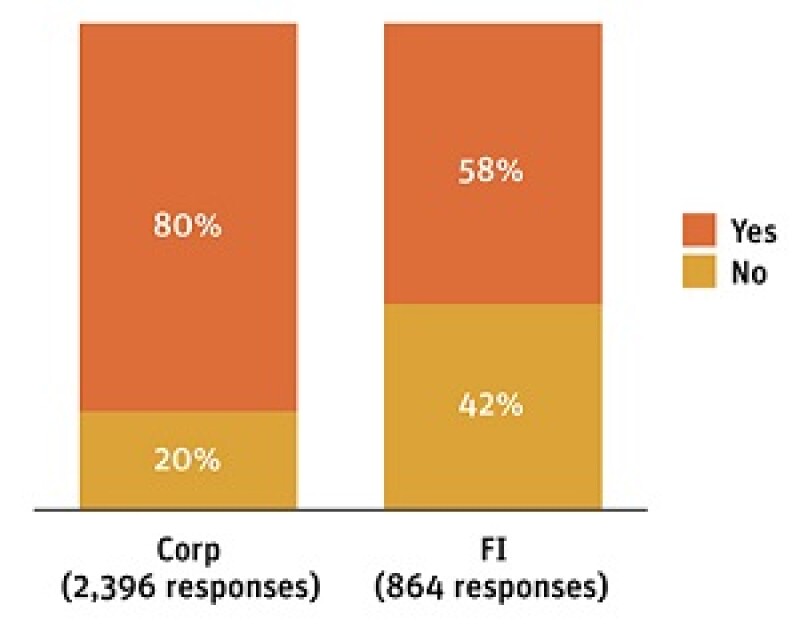

Have you used a non-banking financial company (e.g. Alipay, PayPal) for any cash management services?

The likes of Alipay and PayPal may have won over consumers but they have some way to go to convince the region’s treasury officials. Among corporates, only 15% have used a non-banking financial company for cash management. This rises slightly to 16% for financial institutions but shows that the new technology is yet to provide a serious challenge to traditional cash management providers. It seems that this hesitancy is pretty uniform across Asia. When broken down by country, the use of NBFCs is around the same level as the average. For example in China, the biggest sample size we have for any country, 15% of corporates have used an NBFC while for FIs the percentage is 20%.

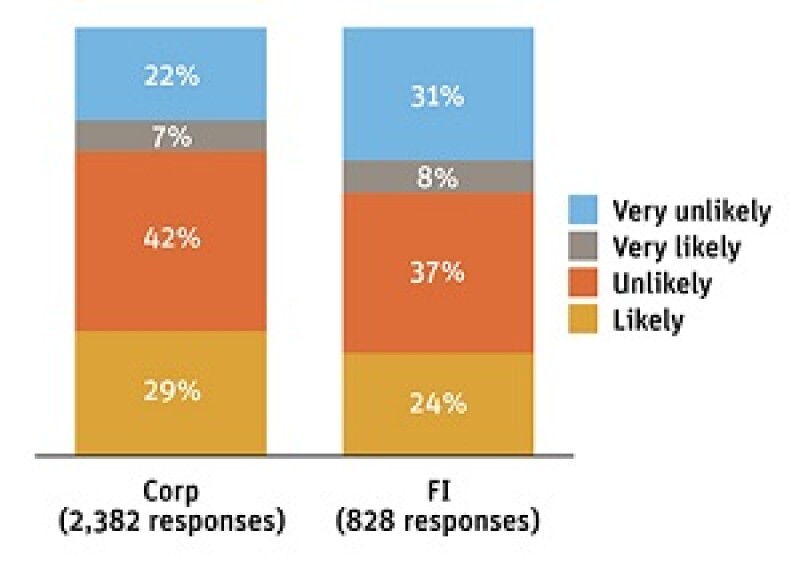

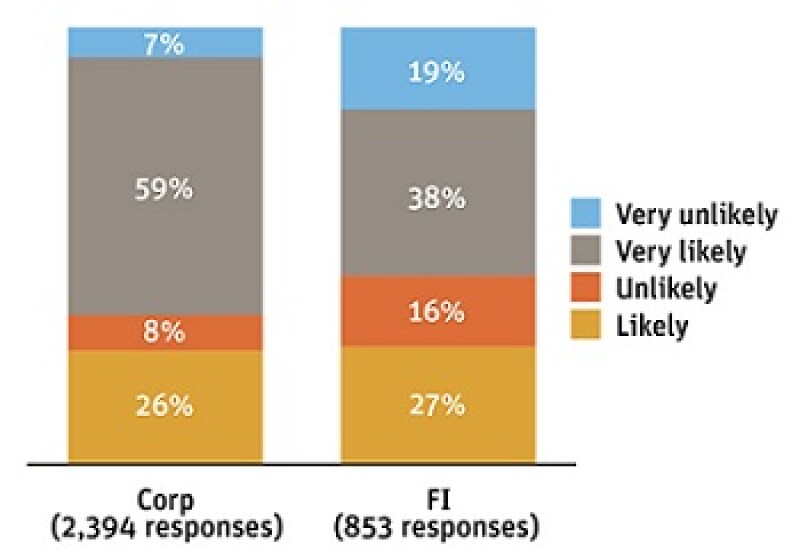

What is the likelihood of you using a NBFC for cash management services in the future?

And it looks like that resistance is likely to remain for some time. While the percentage of treasurers who are looking to use a NBFC in the future shows there will be some pick up in usage from the numbers that have already adopted the technology, it remains a minority. Corporates are slightly keener on NBFCs with 36% saying they are likely or very likely to use non-traditional cash managers in the future. For financial institutions that figure falls to 32%. NBFCs seem aware of this reluctance which is why so many are forming partnerships with banks. The combination of the new technology with the institutional strength of a traditional bank looks set to be the template that will succeed over the longer term.

Have you transacted or settled any trades in renminbi?

The overwhelmingly positive response to this question is explained in part by the large participation of Chinese institutions in the Asiamoney survey. But if Chinese votes are stripped out, the results still show the strong progress that has been made in renminbi payments in just a few years. For ex-China corporates, 61% said they had settled trades in renminbi. The figures are more balanced for financial institutions with 48% using the currency for settlement. At a country level, the renminbi has gained strong traction in Japan with 68% of corporates and 59% of financials. Corporates in the Philippines have proved keen with 85% using the currency but the country’s banks have been slower on the uptake with just 18% responding positively to the question. It is also worth noting that among Chinese respondents, 6% of corporates and 8% of financials have yet to transact in renminbi.

What is the likelihood of you transacting or settling any trades in renminbi in the next 12 months?

The unstoppable march of the renminbi shows no sign of slowing with 85% of corporates and two third of financials expecting to settle trades in renminbi over the next 12 months. Even with China votes stripped out, the results hold up nicely. Seventy per cent of ex-China corporates are in the likely or very likely camp, with the figure for financials coming in at 56%. Looking at the results for each country, Australia is the only one where a majority of corporates still do not expect to transact in renminbi. In contrast, 58% of the country’s banks expect to use the currency over the next 12 months.